Question: I need text answer for all questions 593 A machinery is purchased on June 12, 2006 for Rs.60000. Another machinery is purchased on January 22,

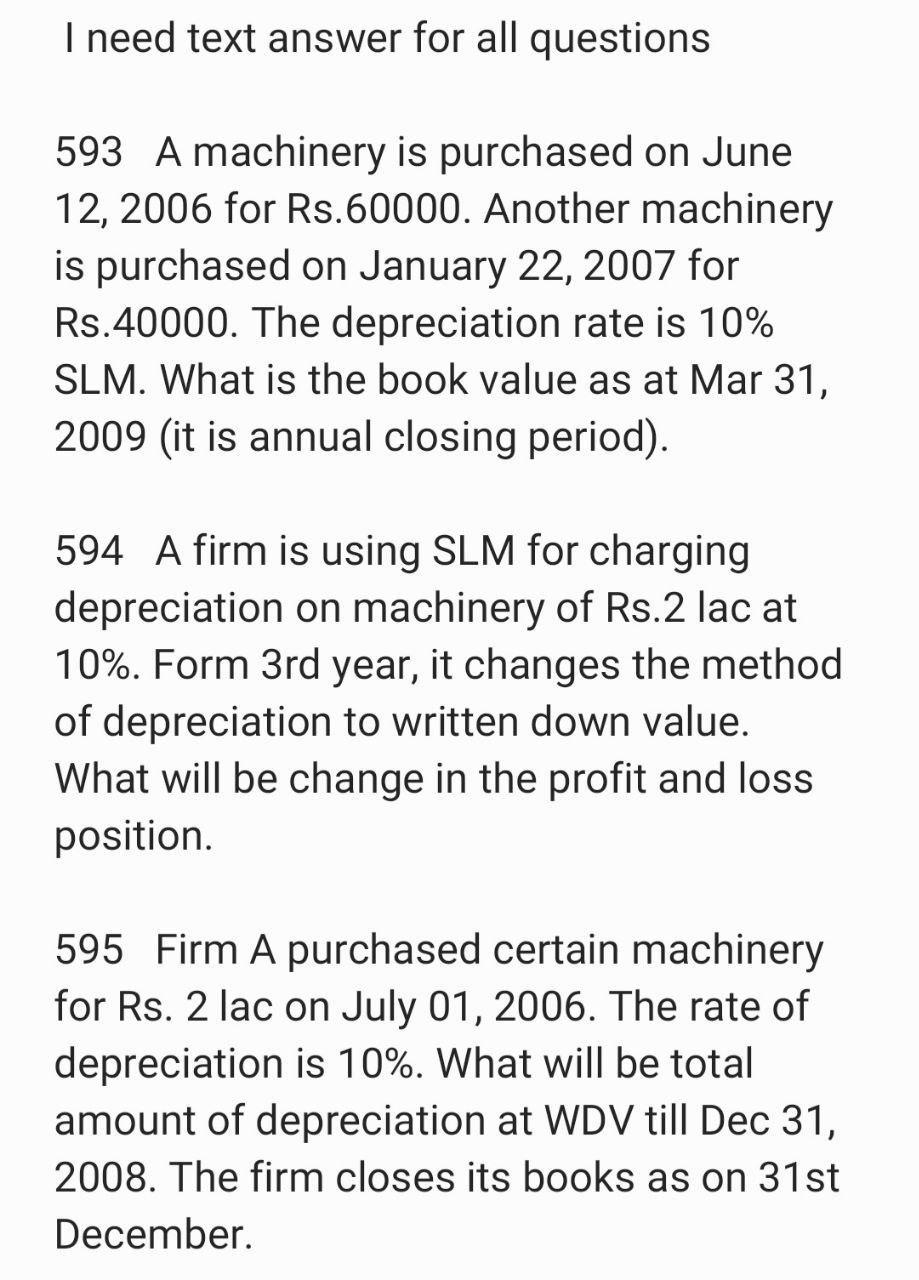

I need text answer for all questions 593 A machinery is purchased on June 12, 2006 for Rs.60000. Another machinery is purchased on January 22, 2007 for Rs.40000. The depreciation rate is 10% SLM. What is the book value as at Mar 31, 2009 (it is annual closing period). 594 A firm is using SLM for charging depreciation on machinery of Rs. 2 lac at 10%. Form 3rd year, it changes the method of depreciation to written down value. What will be change in the profit and loss position. 595 Firm A purchased certain machinery for Rs. 2 lac on July 01, 2006. The rate of depreciation is 10%. What will be total amount of depreciation at WDV till Dec 31, 2008. The firm closes its books as on 31st December

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts