Question: I need the answer as soon as possible 11. Gary is a self-employed CPA whose 2018 net earnings from his trade or business (before the

I need the answer as soon as possible

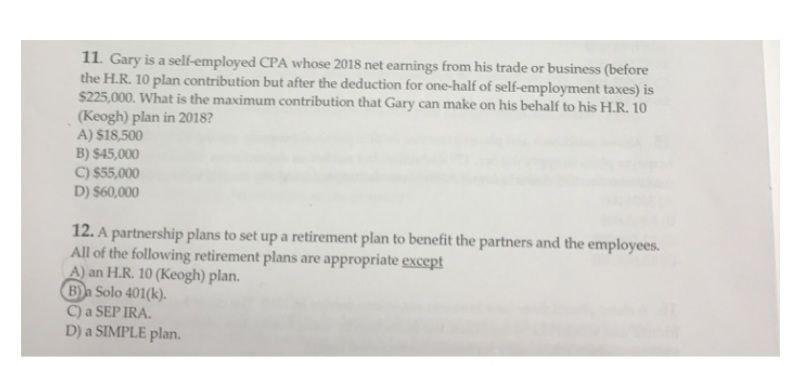

11. Gary is a self-employed CPA whose 2018 net earnings from his trade or business (before the H.R. 10 plan contribution but after the deduction for one-half of self-employment taxes) is $225,000. What is the maximum contribution that Gary can make on his behalf to his H.R. 10 (Keogh) plan in 2018? A) $18,500 B) $45,000 C) $55,000 D) $60,000 12. A partnership plans to set up a retirement plan to benefit the partners and the employees. All of the following retirement plans are appropriate except A) an H.R. 10 (Keogh) plan. B) a Solo 401(k). C) a SEP IRA. D) a SIMPLE plan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts