Question: I need the answer as soon as possible a Question #3 Sultan Ahmed, an investment banker, is considering buying 100 shares of Alpha Limited, at

I need the answer as soon as possible

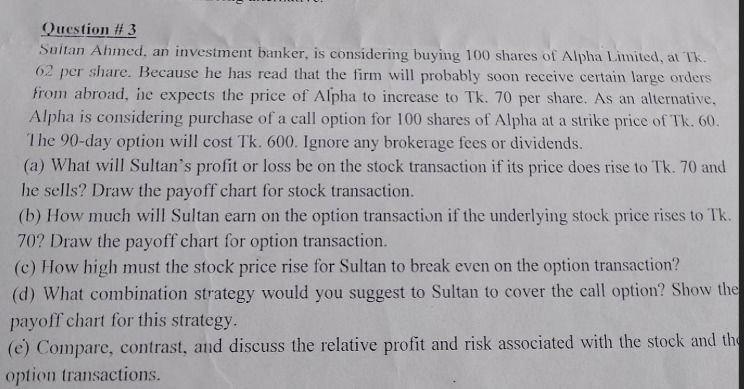

a Question #3 Sultan Ahmed, an investment banker, is considering buying 100 shares of Alpha Limited, at Tk. 02 per share. Because he has read that the firm will probably soon receive certain large orders from abroad, he expects the price of Alpha to increase to Tk. 70 per share. As an alternative, Alpha is considering purchase of a call option for 100 shares of Alpha at a strike price of Tk. 60. The 90-day option will cost Tk. 600. Ignore any brokerage fees or dividends. (a) What will Sultan's profit or loss be on the stock transaction if its price does rise to Tk. 70 and he sells? Draw the payoff chart for stock transaction. (b) How much will Sultan earn on the option transaction if the underlying stock price rises to Tk. 70? Draw the payoff chart for option transaction. (c) How high must the stock price rise for Sultan to break even on the option transaction? (d) What combination strategy would you suggest to Sultan to cover the call option? Show the payoff chart for this strategy. (e) Compare, contrast, and discuss the relative profit and risk associated with the stock and the option transactions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts