Question: I need the answer as soon as possible At the year end of T Down & Co, an imbalance in the trial balance was revealed

I need the answer as soon as possible

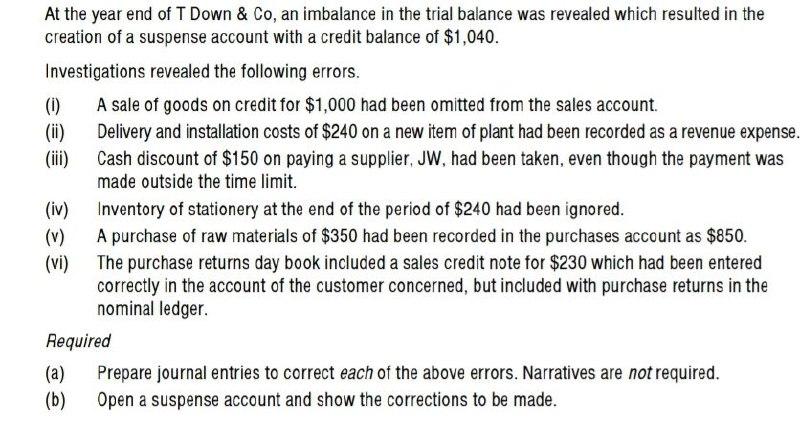

At the year end of T Down & Co, an imbalance in the trial balance was revealed which resulted in the creation of a suspense account with a credit balance of $1,040. Investigations revealed the following errors. (1) A sale of goods on credit for $1,000 had been omitted from the sales account. Delivery and installation costs of $240 on a new item of plant had been recorded as a revenue expense. Cash discount of $150 on paying a supplier, JW, had been taken, even though the payment was made outside the time limit. Inventory of stationery at the end of the period of $240 had been ignored. A purchase of raw materials of $350 had been recorded in the purchases account as $850. (vi) The purchase returns day book included a sales credit note for $230 which had been entered correctly in the account of the customer concerned, but included with purchase returns in the nominal ledger. Required Prepare journal entries to correct each of the above errors. Narratives are not required. (b) Open a suspense account and show the corrections to be made. (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts