Question: I need the answer as soon as possible Case Study 2: Life Insurance Surprise! Zakiah and Razali were stunned to find that their family of

I need the answer as soon as possible

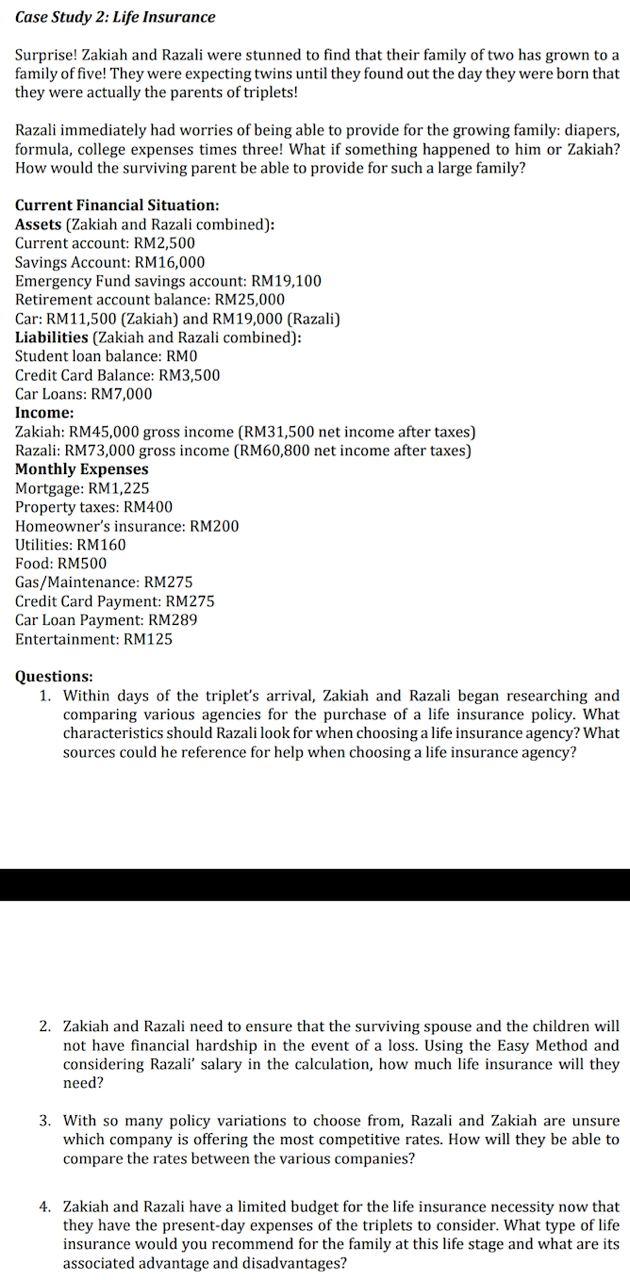

Case Study 2: Life Insurance Surprise! Zakiah and Razali were stunned to find that their family of two has grown to a family of five! They were expecting twins until they found out the day they were born that they were actually the parents of triplets! Razali immediately had worries of being able to provide for the growing family: diapers, formula, college expenses times three! What if something happened to him or Zakiah? How would the surviving parent be able to provide for such a large family? Current Financial Situation: Assets (Zakiah and Razali combined): Current account: RM2,500 Savings Account: RM16,000 Emergency Fund savings account: RM19,100 Retirement account balance: RM25,000 Car: RM11,500 (Zakiah) and RM19,000 (Razali) Liabilities (Zakiah and Razali combined): Student loan balance:RMO Credit Card Balance: RM3,500 Car Loans: RM7,000 Income: Zakiah: RM45,000 gross income (RM31,500 net income after taxes) Razali: RM73,000 gross income (RM60,800 net income after taxes) Monthly Expenses Mortgage: RM1,225 Property taxes: RM400 Homeowner's insurance: RM200 Utilities: RM160 Food: RM500 Gas/Maintenance: RM275 Credit Card Payment: RM275 Car Loan Payment: RM289 Entertainment: RM125 Questions: 1. Within days of the triplet's arrival, Zakiah and Razali began researching and comparing various agencies for the purchase of a life insurance policy. What characteristics should Razali look for when choosing a life insurance agency? What sources could he reference for help when choosing a life insurance agency? 2. Zakiah and Razali need to ensure that the surviving spouse and the children will not have financial hardship in the event of a loss. Using the Easy Method and considering Razali' salary in the calculation, how much life insurance will they need? 3. With so many policy variations to choose from, Razali and Zakiah are unsure which company is offering the most competitive rates. How will they be able to compare the rates between the various companies? 4. Zakiah and Razali have a limited budget for the life insurance necessity now that they have the present-day expenses of the triplets to consider. What type of life insurance would you recommend for the family at this life stage and what are its associated advantage and disadvantages

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts