Question: I need the answer as soon as possible Entity P acquired 80% of S several years ago. Entity P presents the statement of profit or

I need the answer as soon as possible

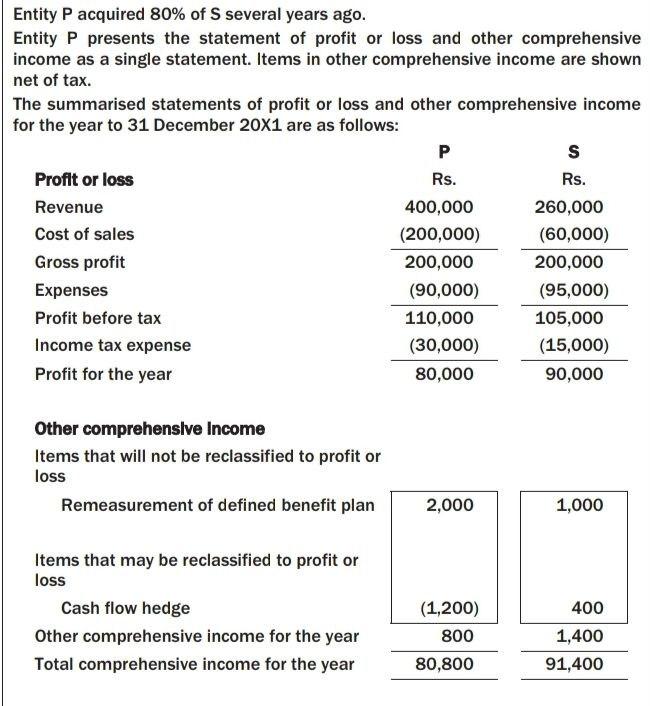

Entity P acquired 80% of S several years ago. Entity P presents the statement of profit or loss and other comprehensive income as a single statement. Items in other comprehensive income are shown net of tax. The summarised statements of profit or loss and other comprehensive income for the year to 31 December 20X1 are as follows: P S Profit or loss Rs. Rs. Revenue 400,000 260,000 Cost of sales (200,000) (60,000) Gross profit 200,000 200,000 Expenses (90,000) (95,000) Profit before tax 110,000 105,000 Income tax expense (30,000) (15,000) Profit for the year 80,000 90,000 Other comprehensive Income Items that will not be reclassified to profit or loss Remeasurement of defined benefit plan 2,000 1,000 Items that may be reclassified to profit or loss Cash flow hedge Other comprehensive income for the year Total comprehensive income for the year (1,200) 800 80,800 400 1,400 91,400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts