Question: I need the answer as soon as possible Instant answer within few minutes please don't waste my turn 6.9. A and B are in partnership

I need the answer as soon as possible

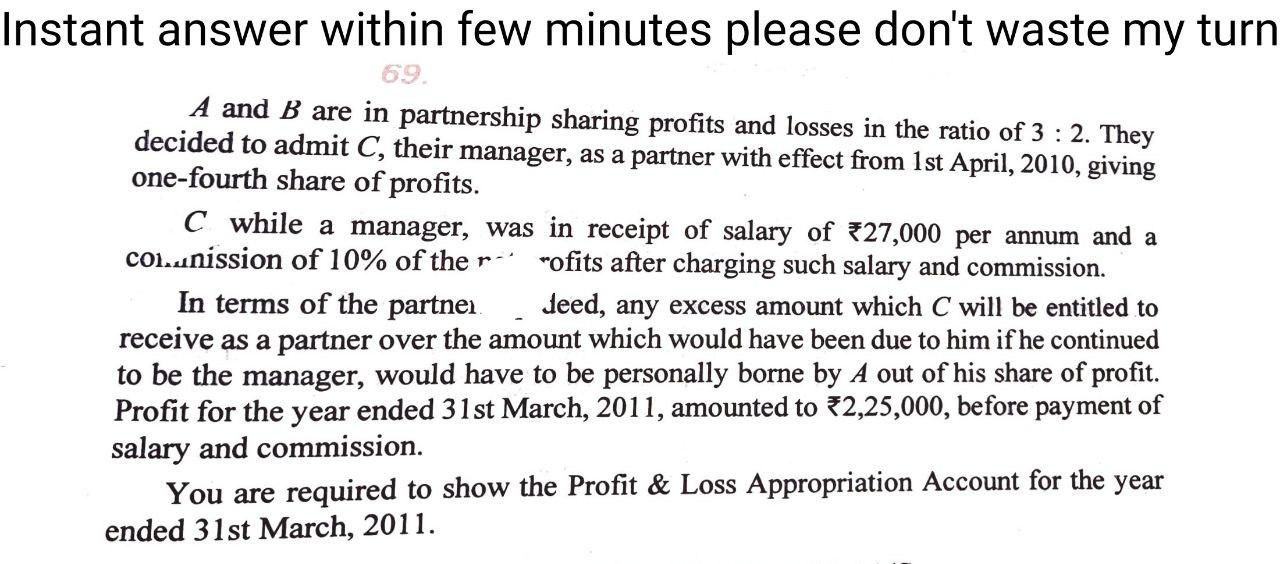

Instant answer within few minutes please don't waste my turn 6.9. A and B are in partnership sharing profits and losses in the ratio of 3 : 2. They decided to admit C, their manager, as a partner with effect from 1st April, 2010, giving one-fourth share of profits. C while a manager, was in receipt of salary of $27,000 per annum and a comunission of 10% of the r- rofits after charging such salary and commission. In terms of the partnei deed, any excess amount which C will be entitled to receive as a partner over the amount which would have been due to him if he continued to be the manager, would have to be personally borne by A out of his share of profit. Profit for the year ended 31st March, 2011, amounted to 2,25,000, before payment of salary and commission. You are required to show the Profit & Loss Appropriation Account for the year ended 31st March, 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts