Question: I need the answer as soon as possible Mr. Mobeen owns different assets. The detail of these assets along with mode and value of acquisition

I need the answer as soon as possible

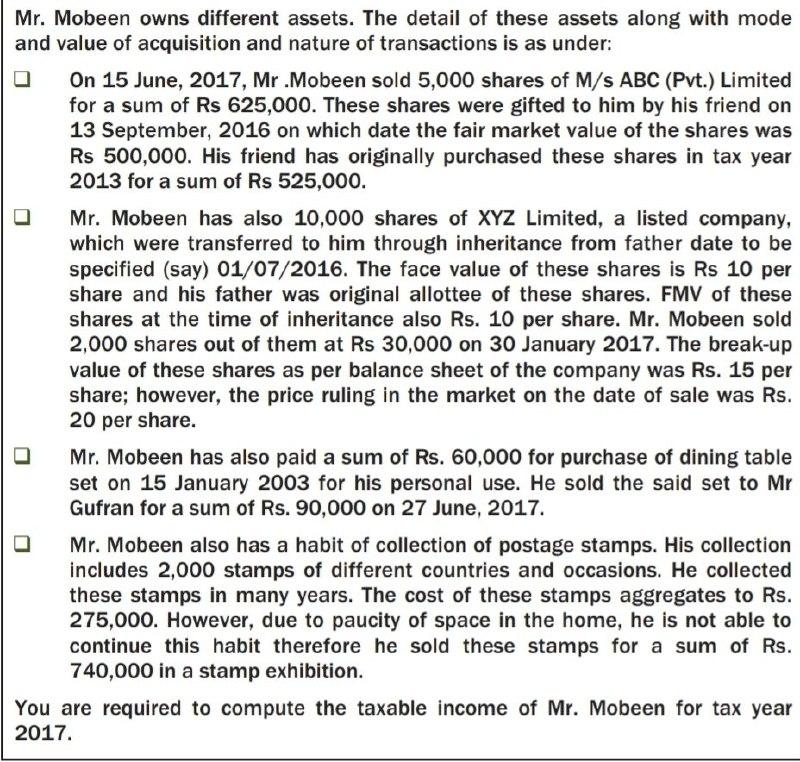

Mr. Mobeen owns different assets. The detail of these assets along with mode and value of acquisition and nature of transactions is as under: On 15 June, 2017, Mr.Mobeen sold 5,000 shares of M/s ABC (Pvt.) Limited for a sum of Rs 625,000. These shares were gifted to him by his friend on 13 September, 2016 on which date the fair market value of the shares was Rs 500,000. His friend has originally purchased these shares in tax year 2013 for a sum of Rs 525,000. Mr. Mobeen has also 10,000 shares of XYZ Limited, a listed company, which were transferred to him through inheritance from father date to be specified (say) 01/07/2016. The face value of these shares is Rs 10 per share and his father was original allottee of these shares. FMV of these shares at the time of inheritance also Rs. 10 per share. Mr. Mobeen sold 2,000 shares out of them at Rs 30,000 on 30 January 2017. The break-up value of these shares as per balance sheet of the company was Rs. 15 per share; however, the price ruling in the market on the date of sale was Rs. 20 per share. Mr. Mobeen has also paid a sum of Rs. 60,000 for purchase of dining table set on 15 January 2003 for his personal use. He sold the said set to Mr Gufran for a sum of Rs. 90,000 on 27 June, 2017. Mr. Mobeen also has a habit of collection of postage stamps. His collection includes 2,000 stamps of different countries and occasions. He collected these stamps in many years. The cost of these stamps aggregates to Rs. 275,000. However, due to paucity of space in the home, he is not able to continue this habit therefore he sold these stamps for a sum of Rs. 740,000 in a stamp exhibition. You are required to compute the taxable income of Mr. Mobeen for tax year 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts