Question: I need the answer as soon as possible On 13 September 2016, Azhar purchased a building which had been previously used as a factory in

I need the answer as soon as possible

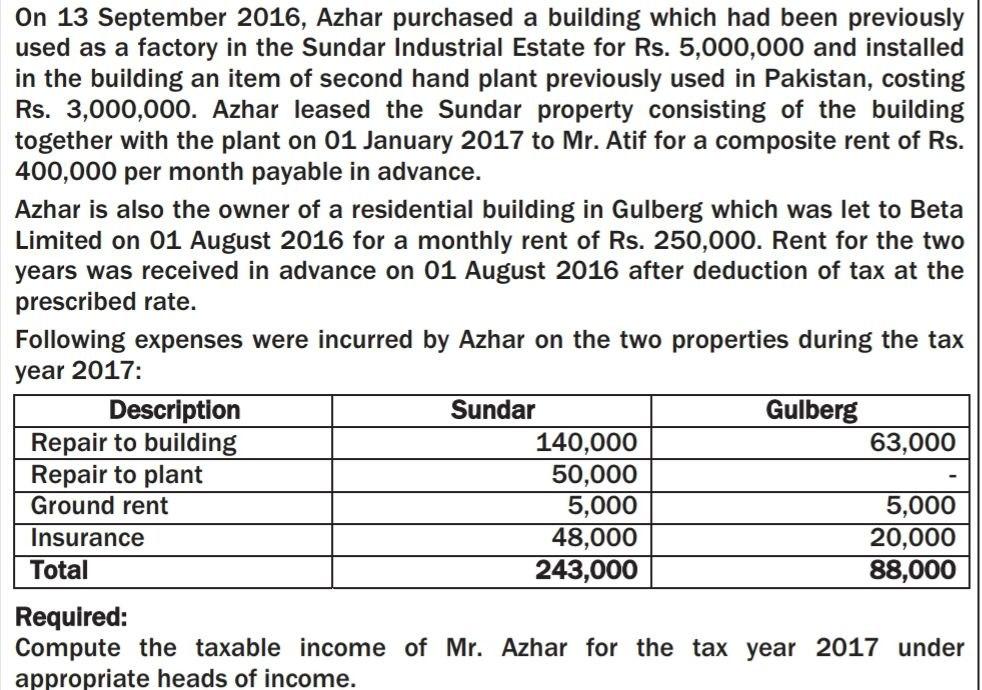

On 13 September 2016, Azhar purchased a building which had been previously used as a factory in the Sundar Industrial Estate for Rs. 5,000,000 and installed in the building an item of second hand plant previously used in Pakistan, costing Rs. 3,000,000. Azhar leased the Sundar property consisting of the building together with the plant on 01 January 2017 to Mr. Atif for a composite rent of Rs. 400,000 per month payable in advance. Azhar is also the owner of a residential building in Gulberg which was let to Beta Limited on 01 August 2016 for a monthly rent of Rs. 250,000. Rent for the two years was received in advance on 01 August 2016 after deduction of tax at the prescribed rate. Following expenses were incurred by Azhar on the two properties during the tax year 2017: Description Sundar Gulberg Repair to building 140,000 63,000 Repair to plant 50,000 Ground rent 5,000 5,000 Insurance 48,000 20,000 Total 243,000 88,000 Required: Compute the taxable income of Mr. Azhar for the tax year 2017 under appropriate heads of income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts