Question: I need the answer as soon as possible P Ltd acquires a 100% subsidiary on 31 December 20X6.for Rs. 600,000. The subsidiary's deferred taxation position

I need the answer as soon as possible

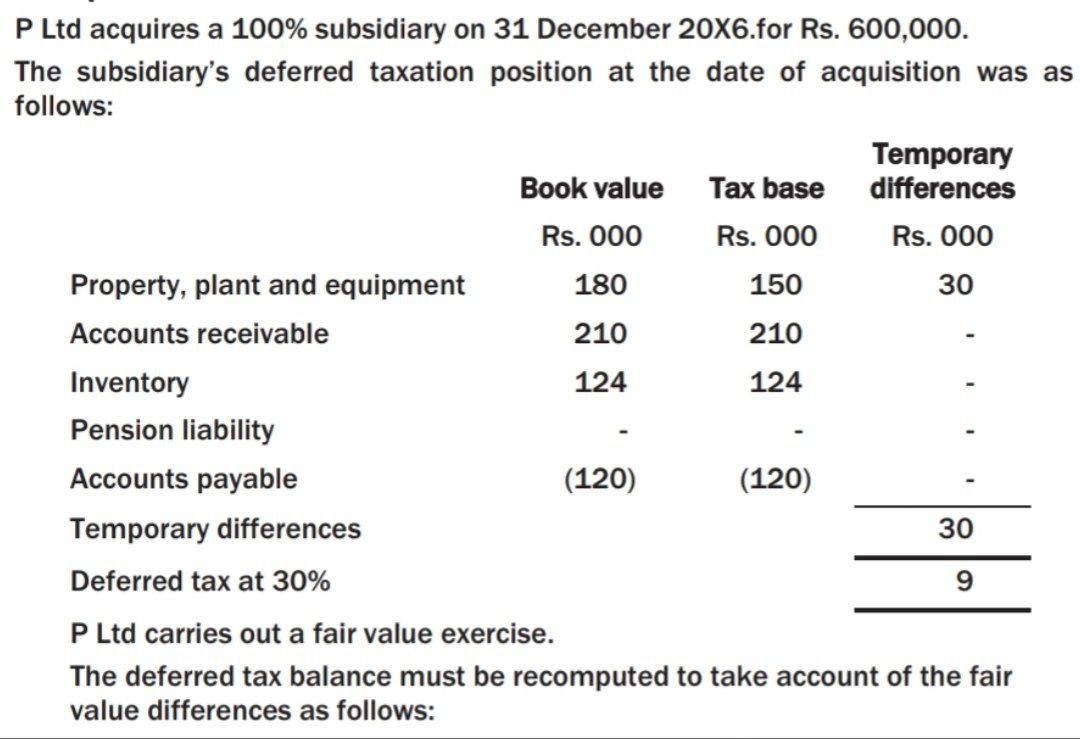

P Ltd acquires a 100% subsidiary on 31 December 20X6.for Rs. 600,000. The subsidiary's deferred taxation position at the date of acquisition was as follows: Temporary Book value Tax base differences Rs. 000 Rs. 000 Rs. 000 Property, plant and equipment 180 150 30 Accounts receivable 210 210 Inventory 124 124 Pension liability Accounts payable (120) (120) Temporary differences 30 Deferred tax at 30% 9 P Ltd carries out a fair value exercise. The deferred tax balance must be recomputed to take account of the fair value differences as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts