Question: I need the answer as soon as possible Question # 3: Assume that you have just been hirod as a financial analyst by Tropical Sweets

I need the answer as soon as possible

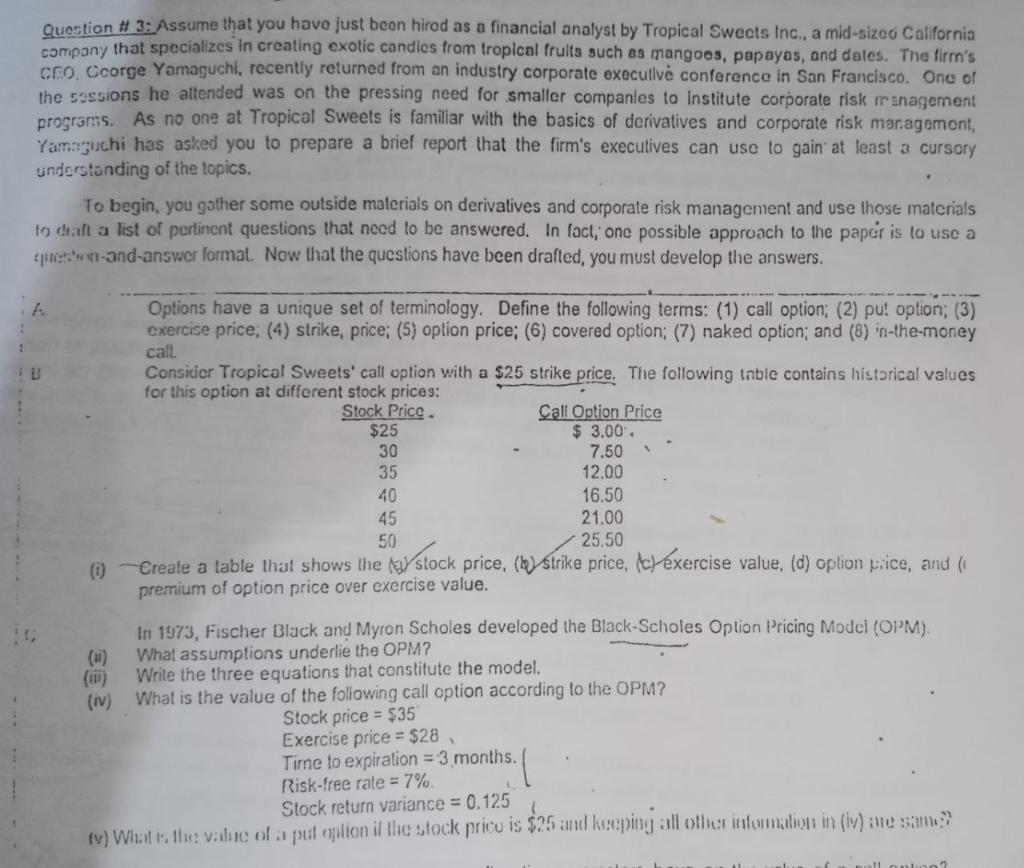

Question # 3: Assume that you have just been hirod as a financial analyst by Tropical Sweets Inc., a mid-sized California company that specializes in creating exotic candies from tropical fruits such as mangoos, papayas, and dates. The firm's CEO. Ccorge Yamaguchi, recently returned from an industry corporate executive conference in San Francisco. One of the sossions he altended was on the pressing need for smaller companles to Institute corporate risk ranagement programs. As no one at Tropical Sweets is familiar with the basics of derivatives and corporate risk management, Yamaguchi has asked you to prepare a brief report that the firm's executives can use to gain at least a cursory understanding of the topics. To begin, you gather some outside materials on derivatives and corporate risk management and use those materials to craft a list of pertinent questions that need to be answered. In fact, one possible approach to the paper is to use a preston-and-answer format. Now that the questions have been drafted, you must develop the answers. A Options have a unique set of terminology. Define the following terms: (1) call option; (2) put option; (3) exercise price; (4) strike, price; (5) option price; (6) covered option; (7) naked option; and (8) in-the-money : call IB Consider Tropical Sweets' call option with a $25 strike price. The following table contains historical values for this option at different stock prices: Stock Price Call Option Price $25 $ 3.00 30 7.50 35 12.00 40 16.50 45 50 25.50 21.00 Create a table that shows the day stock price, (eStrike price, cxercise value, (d) oplion price, and ( premium of option price over exercise value. 10 In 1973, Fischer Black and Myron Scholes developed the Black-Scholes Option Pricing Model (OPM) What assumptions underlie the OPM? Write the three equations that constitute the model. (iv) What is the value of the following call option according to the OPM? Stock price = $35 Exercise price = $28 Time to expiration = 3 months. Risk-free rate = 7% Stock return variance = 0.125 (v) Wits the value of a put option if the stock pricu is $25 and keeping all other information in (iv) are some laluan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts