Question: I need the answer as soon as possible Question 5 a) Jenifer owns a freehold property in Jurong East. She receives an income of $24,000

I need the answer as soon as possible

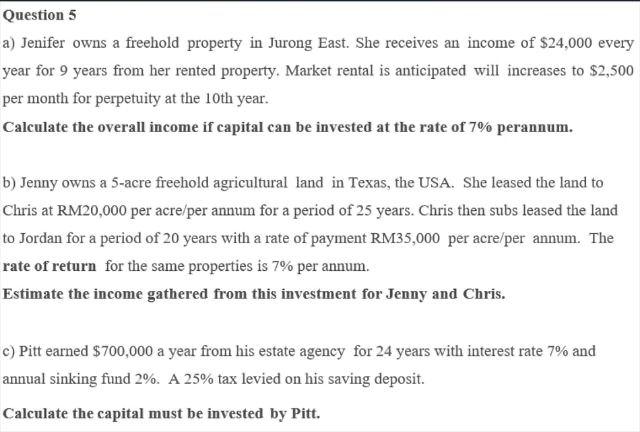

Question 5 a) Jenifer owns a freehold property in Jurong East. She receives an income of $24,000 every year for 9 years from her rented property. Market rental is anticipated will increases to $2,500 per month for perpetuity at the 10th year. Calculate the overall income if capital can be invested at the rate of 7% perannum. b) Jenny owns a 5-acre freehold agricultural land in Texas, the USA. She leased the land to Chris at RM20,000 per acre/per annum for a period of 25 years. Chris then subs leased the land to Jordan for a period of 20 years with a rate of payment RM35,000 per acre/per annum. The rate of return for the same properties is 7% per annum. Estimate the income gathered from this investment for Jenny and Chris. c) Pitt earned $700,000 a year from his estate agency for 24 years with interest rate 7% and annual sinking fund 2%. A 25% tax levied on his saving deposit. Calculate the capital must be invested by Pitt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts