Question: I need the answer as soon as possible. Thanks! D 2. On 01.10.2017. X purchased 5 Machines from Y for 40,00,000. Payment was to be

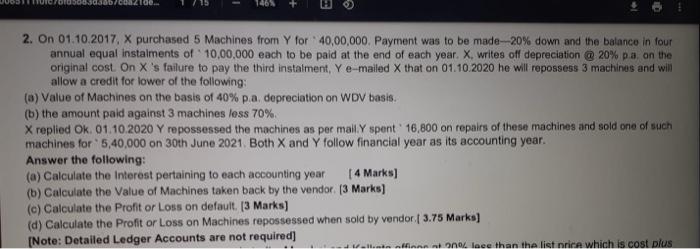

D 2. On 01.10.2017. X purchased 5 Machines from Y for 40,00,000. Payment was to be made-20% down and the balance in four annual equal instalments of 10,00,000 each to be paid at the end of each year. X, writes off depreciation @ 20% pa on the original cost On X's failure to pay the third instalment, Y e-mailed that on 01.10.2020 he will repossess 3 machines and will allow a credit for lower of the following: (6) Value of Machines on the basis of 40% pa depreciation on WDV basis. (b) the amount paid against 3 machines less 70%. X replied Ok 01.10.2020 Y repossessed the machines as per mail spent 16,800 on repairs of these machines and sold one of such machines for 5,40,000 on 30th June 2021 Both X and Y follow financial year as its accounting year. Answer the following: (a) Calculate the Interest pertaining to each accounting year [ 4 Marks) (b) Calculate the value of Machines taken back by the vendor 13 Marks) (c) Calculate the Profit or Loss on default [3 Marks) (d) Calculate the Profit or Loss on Machines repossessed when sold by vendor (3.75 Marks) [Note: Detailed Ledger Accounts are not required) hann non laee than the list nice which is cost plus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts