Question: I need the answer as soon as possiple please 10. Page Company issued bonds with a face value of $200,000 at 97. How does the

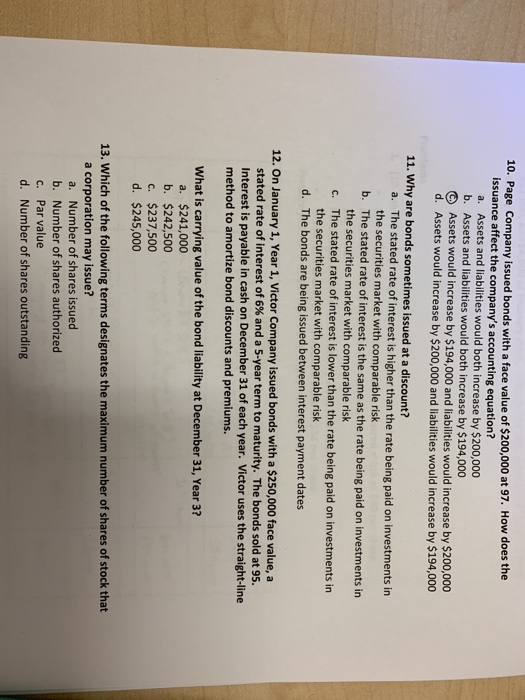

10. Page Company issued bonds with a face value of $200,000 at 97. How does the issuance affect the company's accounting equation? a. Assets and liabilities would both increase by $200,000 b. Assets and liabilities would both increase by $194,000 c) Assets would increase by $194,000 and liabilities would increase by $200,000 d. Assets would increase by $200,000 and liabilities would increase by $194,000 11. Why are bonds sometimes issued at a discount? The stated rate of interest is higher than the rate being paid on investments in the securities market with comparable risk The stated rate of interest is the same as the rate being paid on investments in the securities market with comparable risk The stated rate of interest is lower than the rate being paid on investments in the securities market with comparable risk The bonds are being issued between interest payment dates a. b. c. d. 12. On January 1, Year 1, Victor Company issued bonds with a $250,000 face value, a stated rate of interest of 6% and a 5-year term to maturity. The bonds sold at 95. Interest is payable in cash on December 31 of each year. Victor uses the straight-line method to amortize bond discounts and premiums. What is carrying value of the bond liability at December 31, Year 3? a. $241,000 b. $242,500 c. $237,500 d. $245,000 13. Which of the following terms designates the maximum number of shares of stock that a corporation may issue? Number of shares issued Number of shares authorized Par value Number of shares outstanding a. b. c. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts