Question: I need the answer asap January 30, 2014 Multiple Choice (2 Points each) 1. Over the past year, a firm decreased its current assets and

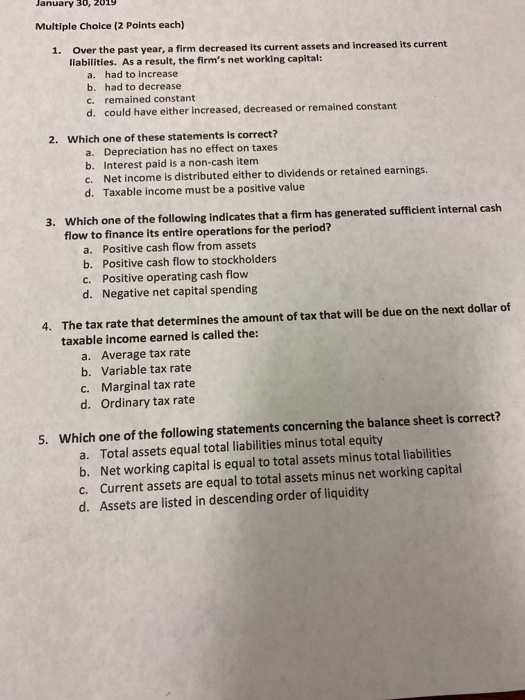

January 30, 2014 Multiple Choice (2 Points each) 1. Over the past year, a firm decreased its current assets and increased its current liabilities. As a result, the firm's net working capital: a. had to increase b. had to decrease C. remained constant d. could have either increased, decreased or remained constant 2. Which one of these statements is correct? a. Depreciation has no effect on taxes b. Interest paid is a non-cash item c. Net income is distributed either to dividends or retained earnings. d. Taxable income must be a positive value 3. Which one of the following indicates that a firm has generated sufficient internal cash flow to finance its entire operations for the period? a. Positive cash flow from assets b. Positive cash flow to stockholders c. Positive operating cash flow d. Negative net capital spending 4. The tax rate that determines the amount of tax that will be due on the next dollar of taxable income earned is called the: a. Average tax rate b. Variable tax rate C. Marginal tax rate d. Ordinary tax rate 5. Which one of the following statements concerning the balance sheet is correct? a. Total assets equal total liabilities minus total equity b. Net working capital is equal to total assets minus total liabilities C. Current assets are equal to total assets minus net working capital d. Assets are listed in descending order of liquidity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts