Question: I need the answer ASAP Question 3 3 points On January 1, 2020, Sitra Company leased equipment from National Corporation. Lease payments are $300,000, payable

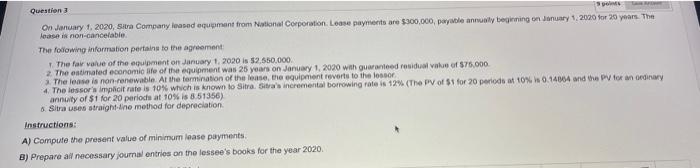

Question 3 3 points On January 1, 2020, Sitra Company leased equipment from National Corporation. Lease payments are $300,000, payable annually beginning on January 1, 2020 for 20 years. The lease is non-cancelable. The following information pertains to the agreement 1. The fair value of the equipment on January 1, 2020 is $2,550,000 2. The estimated economic life of the equipment was 25 years on January 1, 2020 with guaranteed residual value of $75,000 3. The lease is non-renewable. At the termination of the lease, the equipment reverts to the lessor. 4. The lessor's implicit rate is 10% which is known to Sitra. Sitra's incremental borrowing rate is 12% (The PV of $1 for 20 periods at 10% is 0.14864 and the PV for an ordinary annuity of $1 for 20 periods at 10% is 8.51356) 5. Sitra uses straight-line method for depreciation. Instructions: A) Compute the present value of minimum lease payments. B) Prepare all necessary journal entries on the lessee's books for the year 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts