Question: I need the answer for a only , very fast , please help me, I do not have time , I only have 20 minutes

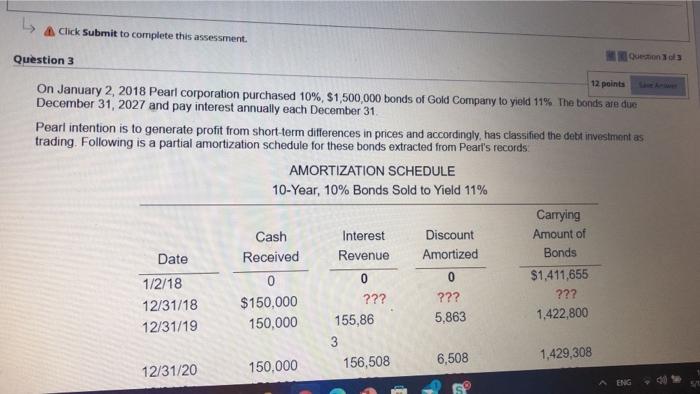

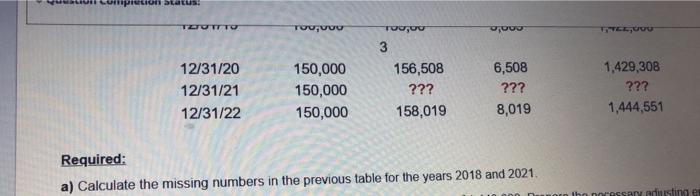

Click Submit to complete this assessment. Question 3 Questions On January 2, 2018 Pearl corporation purchased 10%, $1,500,000 bonds of Gold Company to yield 11% The bonds are due 12 points December 31, 2027 and pay interest annually each December 31 Pearl intention is to generate profit from short-term differences in prices and accordingly, has classified the debt investment as trading. Following is a partial amortization schedule for these bonds extracted from Pearl's records AMORTIZATION SCHEDULE 10-Year, 10% Bonds Sold to Yield 11% Carrying Cash Interest Discount Amount of Date Received Revenue Amortized Bonds 1/2/18 0 0 $1,411,655 12/31/18 $150,000 ??? ??? ??? 12/31/19 150,000 155,86 5,863 1,422,800 0 156,508 6,508 1.429,308 12/31/20 150,000 I Lumpli TETUTTO , iu 12/31/20 12/31/21 12/31/22 150,000 150,000 150,000 3 156,508 ??? 158,019 6,508 ??? 8,019 1,429,308 ??? 1,444,551 Required: a) Calculate the missing numbers in the previous table for the years 2018 and 2021 the ress distings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts