Question: I need the answer for b only , very fast , please help me, I do not have time , I only have 20 minutes

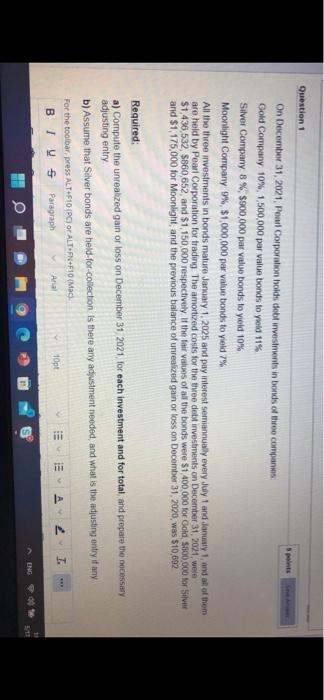

Question 1 points On December 31, 2021, Poul Corporation holds debt investments in bonds of three companies Gold Company 10%, 1,500,000 par value bonds to yold 11% Silver Company 8%, $900,000 par value bonds to yield 10% Moonlight Company 9%, $1,000,000 par value bonds to yield 7% All the three investments in bonds mature January 1, 2025 and pay interest semiannually every July 1 and January 1, and all of them are held by Pearl Corporation for trading The amortized costs for the three debt investments on December 31, 2021, wele $1,436,532, 5860,652, and $1,150,000 respectively if the fair values of all the bonds were $1,400,000 for Gold, 100,000 for Sale and $1,175,000 for Moonlight, and the previous balance of unrealized gain or loss on December 31, 2020 was $10,602 Required: a) Compute the unrealized gain or loss on December 31 2021, for each investment and for total and prepare the necessary adjusting entry b) Assume that Silver bonds are held for collection is there any adjustment needed, and what is the adjusting entry if any For the toolbar, press ALT+F10 (PCOR ALT FN+F10 (Mac BIVS Paragraph Aral Opt I. !!! NG

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts