Question: I need the answer for problem 4, however, I included the necessary information from Problems 1,2,and 3 1. A University bookstore is stocking a new

I need the answer for problem 4, however, I included the necessary information from Problems 1,2,and 3

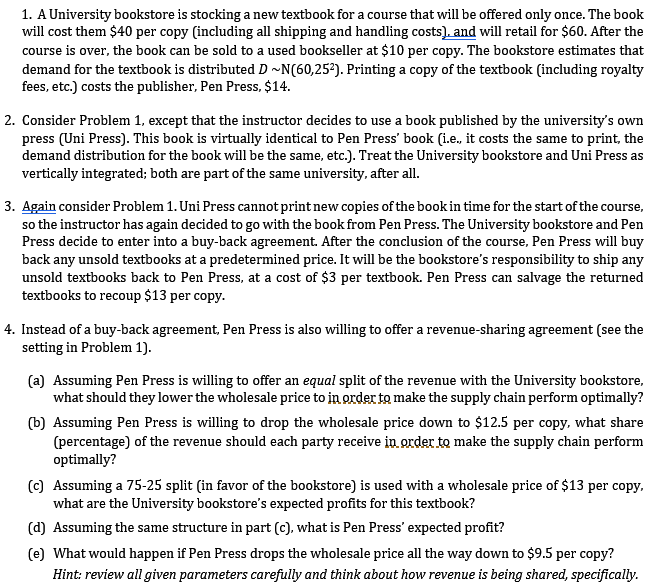

1. A University bookstore is stocking a new textbook for a course that will be offered only once. The book will cost them $40 per copy (including all shipping and handling costs), and will retail for $60. After the course is over, the book can be sold to a used bookseller at $10 per copy. The bookstore estimates that demand for the textbook is distributed D ~N(60,252). Printing a copy of the textbook (including royalty fees, etc.) costs the publisher, Pen Press, $14. 2. Consider Problem 1, except that the instructor decides to use a book published by the university's own press (Uni Press). This book is virtually identical to Pen Press' book i.e., it costs the same to print, the demand distribution for the book will be the same, etc.). Treat the University bookstore and Uni Press as vertically integrated; both are part of the same university, after all. 3. Again consider Problem 1. Uni Press cannot print new copies of the book in time for the start of the course, so the instructor has again decided to go with the book from Pen Press. The University bookstore and Pen Press decide to enter into a buy-back agreement. After the conclusion of the course, Pen Press will buy back any unsold textbooks at a predetermined price. It will be the bookstore's responsibility to ship any unsold textbooks back to Pen Press, at a cost of $3 per textbook. Pen Press can salvage the returned textbooks to recoup $13 per copy. 4. Instead of a buy-back agreement, Pen Press is also willing to offer a revenue sharing agreement (see the setting in Problem 1). (a) Assuming Pen Press is willing to offer an equal split of the revenue with the University bookstore, what should they lower the wholesale price to in order to make the supply chain perform optimally? (b) Assuming Pen Press is willing to drop the wholesale price down to $12.5 per copy, what share (percentage) of the revenue should each party receive in order to make the supply chain perform optimally? (C) Assuming a 75-25 split (in favor of the bookstore) is used with a wholesale price of $13 per copy, what are the University bookstore's expected profits for this textbook? (d) Assuming the same structure in part (c), what is Pen Press' expected profit? (e) What would happen if Pen Press drops the wholesale price all the way down to $9.5 per copy? Hint: review all given parameters carefully and think about how revenue is being shared, specifically. 1. A University bookstore is stocking a new textbook for a course that will be offered only once. The book will cost them $40 per copy (including all shipping and handling costs), and will retail for $60. After the course is over, the book can be sold to a used bookseller at $10 per copy. The bookstore estimates that demand for the textbook is distributed D ~N(60,252). Printing a copy of the textbook (including royalty fees, etc.) costs the publisher, Pen Press, $14. 2. Consider Problem 1, except that the instructor decides to use a book published by the university's own press (Uni Press). This book is virtually identical to Pen Press' book i.e., it costs the same to print, the demand distribution for the book will be the same, etc.). Treat the University bookstore and Uni Press as vertically integrated; both are part of the same university, after all. 3. Again consider Problem 1. Uni Press cannot print new copies of the book in time for the start of the course, so the instructor has again decided to go with the book from Pen Press. The University bookstore and Pen Press decide to enter into a buy-back agreement. After the conclusion of the course, Pen Press will buy back any unsold textbooks at a predetermined price. It will be the bookstore's responsibility to ship any unsold textbooks back to Pen Press, at a cost of $3 per textbook. Pen Press can salvage the returned textbooks to recoup $13 per copy. 4. Instead of a buy-back agreement, Pen Press is also willing to offer a revenue sharing agreement (see the setting in Problem 1). (a) Assuming Pen Press is willing to offer an equal split of the revenue with the University bookstore, what should they lower the wholesale price to in order to make the supply chain perform optimally? (b) Assuming Pen Press is willing to drop the wholesale price down to $12.5 per copy, what share (percentage) of the revenue should each party receive in order to make the supply chain perform optimally? (C) Assuming a 75-25 split (in favor of the bookstore) is used with a wholesale price of $13 per copy, what are the University bookstore's expected profits for this textbook? (d) Assuming the same structure in part (c), what is Pen Press' expected profit? (e) What would happen if Pen Press drops the wholesale price all the way down to $9.5 per copy? Hint: review all given parameters carefully and think about how revenue is being shared, specifically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts