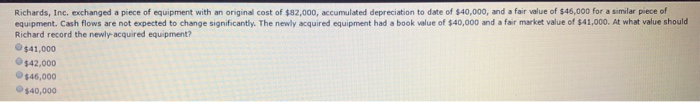

Question: I need the answer for this question. Which answer is correct? Thank you! original cost of $82,ooo, accumulated depreciation to date of s40,000, and afair

original cost of $82,ooo, accumulated depreciation to date of s40,000, and afair value of s45,000 for a similar piece of of equipment with an Richards, Inc. exchanged a piece equipment. Cash flows are not expected to change significantly. The newly acquired equipment had a book value of $40,000 and a fair market value of $41,000. At what value should Richard record the newly acquired equipment? $41,000 0$42,000 O$46,000 $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts