Question: i need the answer from 19 to 24,thanks 19. Based on the information of Question 18, write down the value of historical (raw) beta for

i need the answer from 19 to 24,thanks

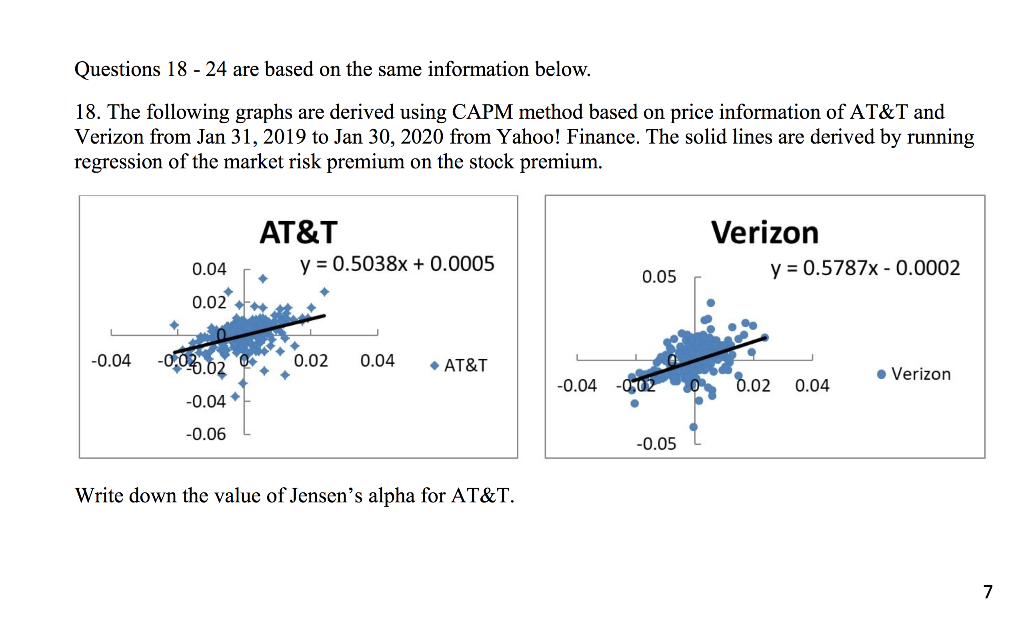

19. Based on the information of Question 18, write down the value of historical (raw) beta for AT&T. 20. Based on the information of Question 18, is AT&T alone a good investment? 21. Based on the information of Question 18, write down the value of Jensen's alpha for Verizon. 22. Based on the information of Question 18, write down the value of historical (raw) beta for Verizon. 23. Based on the information of Question 18, is Verizon alone a good investment? 24. Based on the information of Question 18, use market neutral and pair trading rategy, and the two stocks alpha and raw beta values, decide how to allocate your wealth on these two stocks to achieve a successful market neutral portfolio. Please show all your work. Questions 18 - 24 are based on the same information below. 18. The following graphs are derived using CAPM method based on price information of AT&T and Verizon from Jan 31, 2019 to Jan 30, 2020 from Yahoo! Finance. The solid lines are derived by running regression of the market risk premium on the stock premium. AT&T y = 0.5038x + 0.0005 Verizon y = 0.5787x -0.0002 0.04 0.05 0.02 -0.04 -0.02.02 0.02 0.04 AT&T Verizon -0.04 0.02 0.04 -0.04 -0.06 -0.05 Write down the value of Jensen's alpha for AT&T. 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts