Question: I need the answer of question A to E please 2:20 Done FINANCIAL MANAGEMENT... SCHOOL OF BUSINESS FINANCIAL MANAGEMENT ANSWERALL QUESTIONS DUE DATE ON COMPLETION

I need the answer of question A to E please

I need the answer of question A to E please

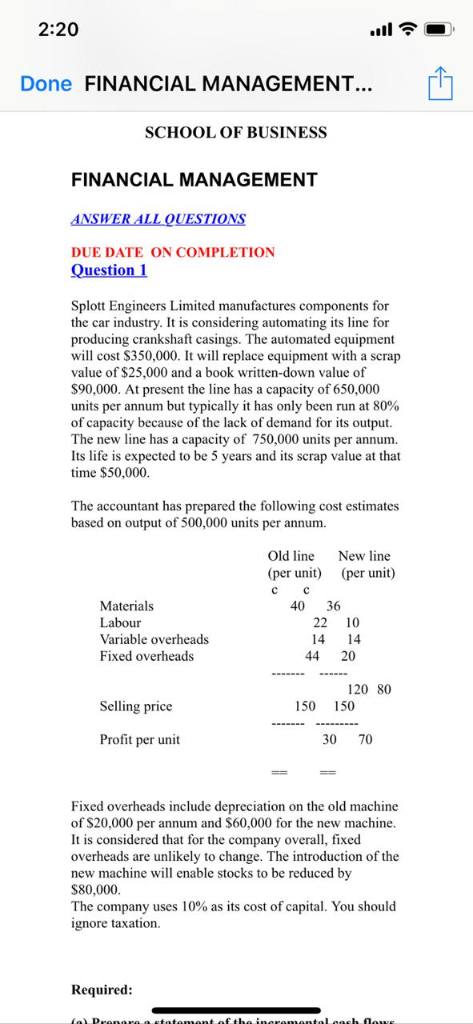

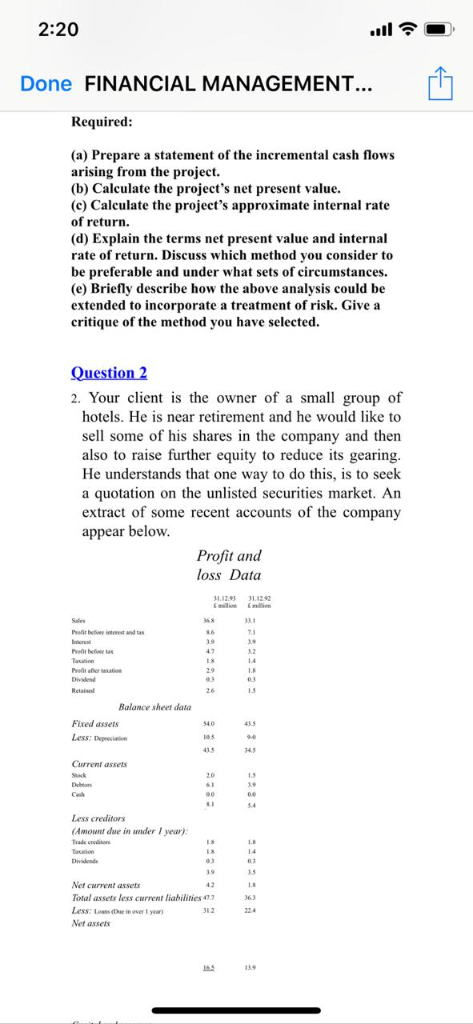

2:20 Done FINANCIAL MANAGEMENT... SCHOOL OF BUSINESS FINANCIAL MANAGEMENT ANSWERALL QUESTIONS DUE DATE ON COMPLETION Splott Engineers Limited manufactures components for the car industry. It is considering automating its line for producing crankshaft casings. The automated equipment will cost S350,000. It will replace equipment with a scrap value of $25,000 and a book written-down value of $90,000. At present the line has a capacity of 650,000 units per annum but typically it has only been run at 80% of capacity because of the lack of demand for its output. The new line has a capacity of 750,000 units per annum. Its life is expected to be 5 years and its scrap value at that time $50,000 The accountant has prepared the following cost estimates based on output of 500,000 units per annum. Old line New line (per unit) (per unit) c C Materials 40 36 22 10 Labour Variable overheads 14 14 Fixed overheads 44 20 120 80 Selling price 150 150 Profit per unit 30 70 Fixed overheads include depreciation on the old machine of S20,000 per annum and $60,000 for the new machine It is considered that for the company overall, fixed overheads are unlikely to change. The introduction of the new machine will enable stocks to be reduced by $80,000 The company uses 10% as its cost of capital. You should gnore taxation Required 2:20 Done FINANCIAL MANAGEMENT... Required (a) Prepare a statement of the incremental cash flows arising from the project. (b) Calculate the project's net present value. (c) Calculate the project's approximate internal rate of return. (d) Explain the terms net present value and internal rate of return. Discuss which method you consider to be preferable and under what sets of circumstances. (e) Briefly describe how the above analysis could be extended to incorporate a treatment of risk. Give a critique of the method you have selected. 2. Your client is the owner of a small group of hotels. He is near retirement and he would like to sell some of his shares in the company and then also to raise further equity to reduce its gearing He understands that one way to do this, is to seek a quotation on the unlisted securities market. An extract of some recent accounts of the company appear below Profit and loss Data 1.12.93 311292 million Emilien 331 73 12 Balance sheet data Fixed assets Less:Depi Crrent assets 20 Less creditors (Amownt due in ander I yeary: Trade croditors 15 Net current assets 42 Total assets less current liabilities 47.7 Net assets 155

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts