Question: i need the answer quickly 2. Consider the following four statements about the delta of option (ceteris paribus implied throughout): 1. As the expiration date

i need the answer quickly

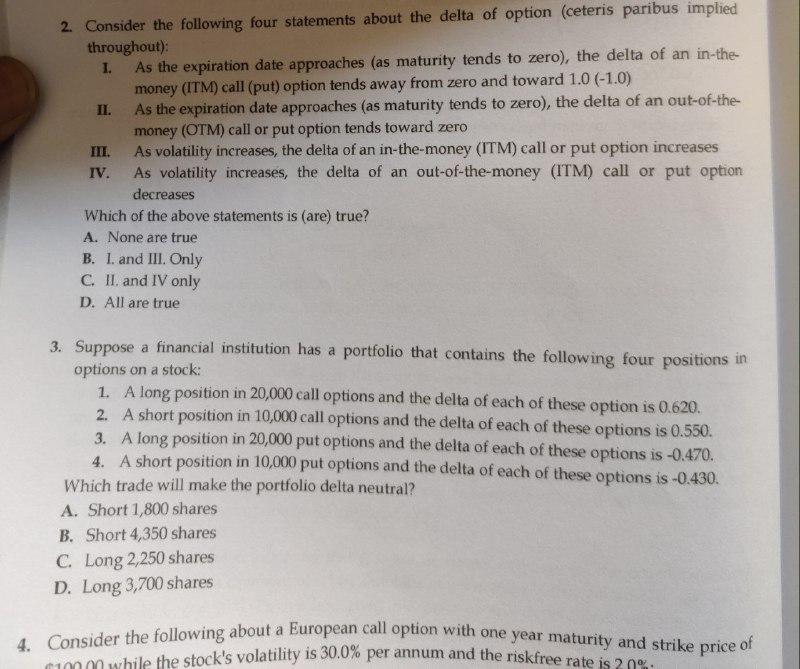

2. Consider the following four statements about the delta of option (ceteris paribus implied throughout): 1. As the expiration date approaches (as maturity tends to zero), the delta of an in-the- money (ITM) call (put) option tends away from zero and toward 1.0 (-1.0) II. As the expiration date approaches (as maturity tends to zero), the delta of an out-of-the- money (OTM) call or put option tends toward zero III. As volatility increases, the delta of an in-the-money (ITM) call or put option increases IV. As volatility increases, the delta of an out-of-the-money (ITM) call or put option decreases Which of the above statements is (are) true? A. None are true B. I. and III. Only C. II and IV only D. All are true 3. Suppose a financial institution has a portfolio that contains the following four positions in options on a stock: 1. A long position in 20,000 call options and the delta of each of these option is 0.620. 2. A short position in 10,000 call options and the delta of each of these options is 0.550. 3. A long position in 20,000 put options and the delta of each of these options is -0.470. 4. A short position in 10,000 put options and the delta of each of these options is -0.430. Which trade will make the portfolio delta neutral? A. Short 1,800 shares B. Short 4,350 shares C. Long 2,250 shares D. Long 3,700 shares 4. Consider the following about a European call option with one year maturity and strike price of com while the stock's volatility is 30.0% per annum and the riskfree rate is 2n 2. Consider the following four statements about the delta of option (ceteris paribus implied throughout): 1. As the expiration date approaches (as maturity tends to zero), the delta of an in-the- money (ITM) call (put) option tends away from zero and toward 1.0 (-1.0) II. As the expiration date approaches (as maturity tends to zero), the delta of an out-of-the- money (OTM) call or put option tends toward zero III. As volatility increases, the delta of an in-the-money (ITM) call or put option increases IV. As volatility increases, the delta of an out-of-the-money (ITM) call or put option decreases Which of the above statements is (are) true? A. None are true B. I. and III. Only C. II and IV only D. All are true 3. Suppose a financial institution has a portfolio that contains the following four positions in options on a stock: 1. A long position in 20,000 call options and the delta of each of these option is 0.620. 2. A short position in 10,000 call options and the delta of each of these options is 0.550. 3. A long position in 20,000 put options and the delta of each of these options is -0.470. 4. A short position in 10,000 put options and the delta of each of these options is -0.430. Which trade will make the portfolio delta neutral? A. Short 1,800 shares B. Short 4,350 shares C. Long 2,250 shares D. Long 3,700 shares 4. Consider the following about a European call option with one year maturity and strike price of com while the stock's volatility is 30.0% per annum and the riskfree rate is 2n

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts