Question: i need the answer quickly 9. Recall that option vega is given by S(O)sqrt(T)*N(an). Each of the following is true about EXCEPT which is false?

i need the answer quickly

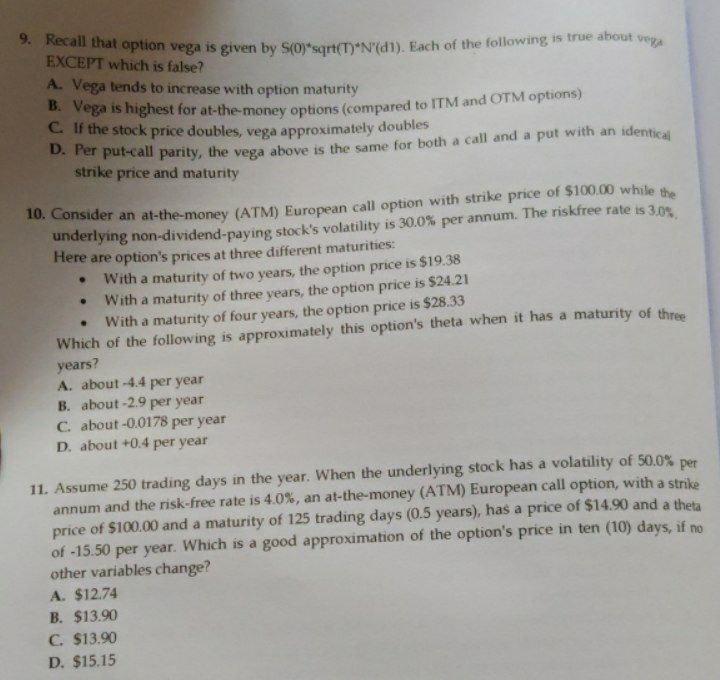

9. Recall that option vega is given by S(O)"sqrt(T)*N"(an). Each of the following is true about EXCEPT which is false? A. Vega tends to increase with option maturity Vega is highest for at-the money options (compared to ITM and OTM options) C. If the stock price doubles, vega approximately doubles D. Per put-call parity, the vega above is the same for both a call and a put with an identical strike price and maturity 10. Consider an at-the-money (ATM) European call option with strike price of $100.00 while the underlying non-dividend paying stock's volatility is 30.0% per annum. The riskfree rate is 3.0% Here are option's prices at three different maturities: With a maturity of two years, the option price is $19.38 With a maturity of three years, the option price is $24.21 With a maturity of four years, the option price is $28.33 Which of the following is approximately this option's theta when it has a maturity of three years? A. about -4.4 per year B. about -2.9 per year C. about -0.0178 per year D. about +0.4 per year . . 11. Assume 250 trading days in the year. When the underlying stock has a volatility of 50.0% per annum and the risk-free rate is 4.0%, an at-the-money (ATM) European call option, with a strike price of $100.00 and a maturity of 125 trading days (0.5 years), has a price of $14.90 and a theta of -15.50 per year. Which is a good approximation of the option's price in ten (10) days, if no other variables change? A. $12.74 B. $13.90 C. $13.90 D. $15.15 9. Recall that option vega is given by S(O)"sqrt(T)*N"(an). Each of the following is true about EXCEPT which is false? A. Vega tends to increase with option maturity Vega is highest for at-the money options (compared to ITM and OTM options) C. If the stock price doubles, vega approximately doubles D. Per put-call parity, the vega above is the same for both a call and a put with an identical strike price and maturity 10. Consider an at-the-money (ATM) European call option with strike price of $100.00 while the underlying non-dividend paying stock's volatility is 30.0% per annum. The riskfree rate is 3.0% Here are option's prices at three different maturities: With a maturity of two years, the option price is $19.38 With a maturity of three years, the option price is $24.21 With a maturity of four years, the option price is $28.33 Which of the following is approximately this option's theta when it has a maturity of three years? A. about -4.4 per year B. about -2.9 per year C. about -0.0178 per year D. about +0.4 per year . . 11. Assume 250 trading days in the year. When the underlying stock has a volatility of 50.0% per annum and the risk-free rate is 4.0%, an at-the-money (ATM) European call option, with a strike price of $100.00 and a maturity of 125 trading days (0.5 years), has a price of $14.90 and a theta of -15.50 per year. Which is a good approximation of the option's price in ten (10) days, if no other variables change? A. $12.74 B. $13.90 C. $13.90 D. $15.15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts