Question: i need the answer quickly Q2: XYZ LTD HAS THE FOLLOWING BOOKVALUE CAPITAL STRUCTURE: EQUITY CAPITAL (IN SHARES OF RS/.10 EACH, FULLY PAID UP AT

i need the answer quickly

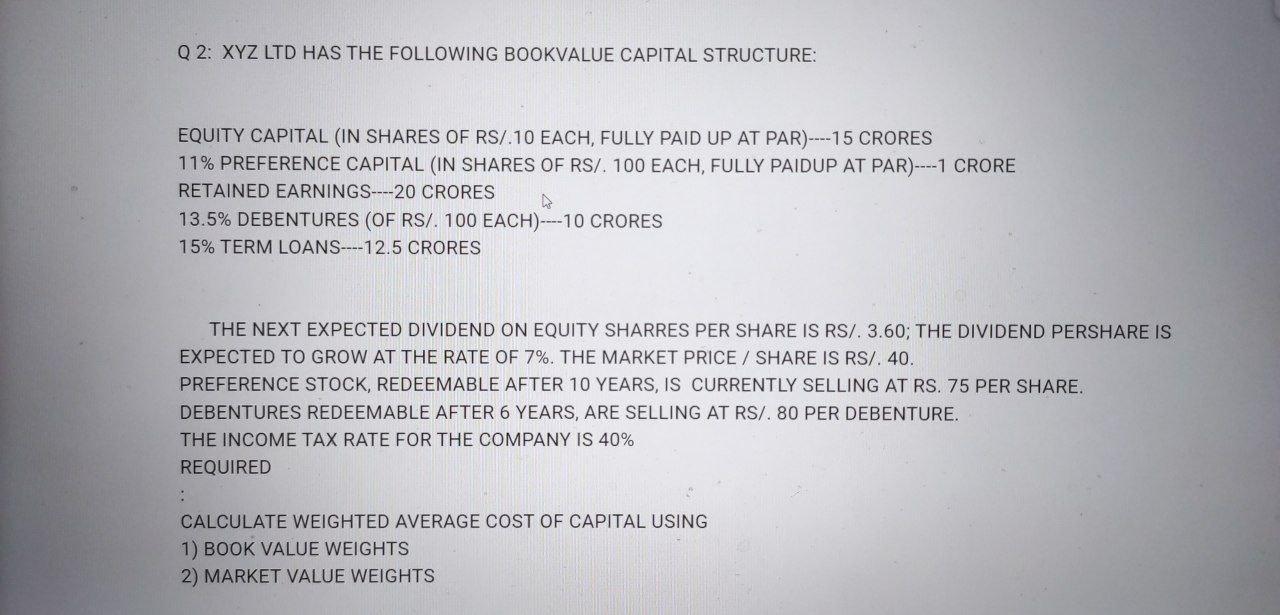

Q2: XYZ LTD HAS THE FOLLOWING BOOKVALUE CAPITAL STRUCTURE: EQUITY CAPITAL (IN SHARES OF RS/.10 EACH, FULLY PAID UP AT PAR----15 CRORES 11% PREFERENCE CAPITAL (IN SHARES OF RS/. 100 EACH, FULLY PAIDUP AT PAR)----1 CRORE RETAINED EARNINGS---20 CRORES 13.5% DEBENTURES (OF RS/. 100 EACH)---10 CRORES 15% TERM LOANS----12.5 CRORES THE NEXT EXPECTED DIVIDEND ON EQUITY SHARRES PER SHARE IS RS/. 3.60; THE DIVIDEND PERSHARE IS EXPECTED TO GROW AT THE RATE OF 7%. THE MARKET PRICE / SHARE IS RS/. 40. PREFERENCE STOCK, REDEEMABLE AFTER 10 YEARS, IS CURRENTLY SELLING AT RS. 75 PER SHARE. DEBENTURES REDEEMABLE AFTER 6 YEARS, ARE SELLING AT RS/. 80 PER DEBENTURE. THE INCOME TAX RATE FOR THE COMPANY IS 40% REQUIRED : CALCULATE WEIGHTED AVERAGE COST OF CAPITAL USING 1) BOOK VALUE WEIGHTS 2) MARKET VALUE WEIGHTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts