Question: i need the answer quickly using a 30 Five years ago a chemical plant investeol. $ 95,000 in pumping station en of Nearuky stiver to

i need the answer quickly

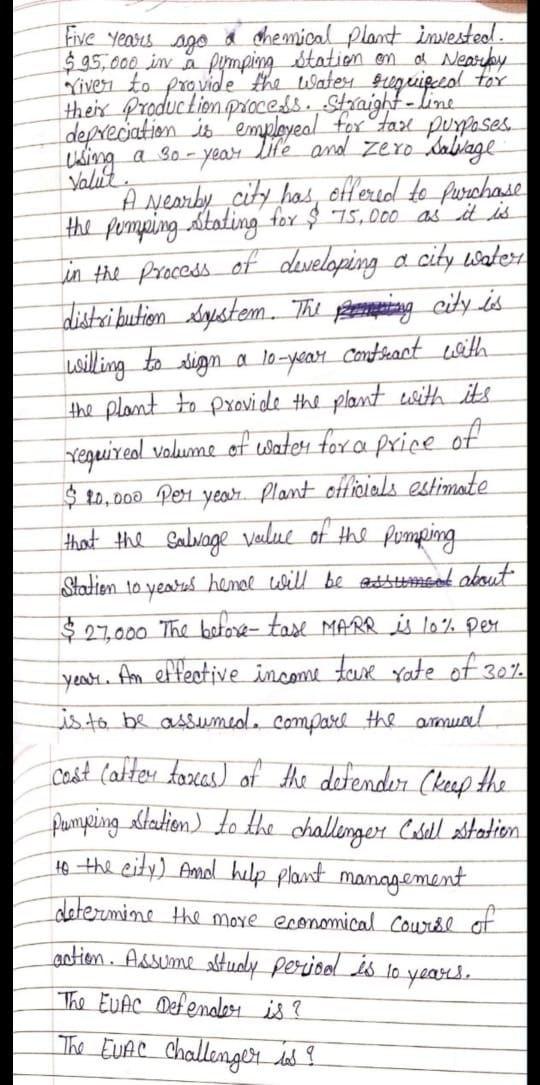

using a 30 Five years ago a chemical plant investeol. $ 95,000 in pumping station en of Nearuky stiver to provide the water puequipecol toy their productim process. Straight-line depreciation is employeal for farl purposes -year life and zero Labiage Valut. A wearby city has, offered to purchase the pumping stating for $75,000 as it is in the process of developing a city water distribution System. The spenning city is willing to sign a 10-year contract with the plant to provide the plant with its requireal volume of water for a price of $ 80,000 per year. Plant officials estimate that the salvage value of the pumping Station 10 years hence will be absent about $27,000 The before- tase MARR is 10% per year. An effective income tax rate of 30% is to be assumedle compare the arwal cost Catter taras) of the defender (keep the pumping Station) to the challenger Caled station to the city) Amol help plant management determine the more economical course of antien. Assume astudy periool is to years The EUAC Defender is? The Evac challenges in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts