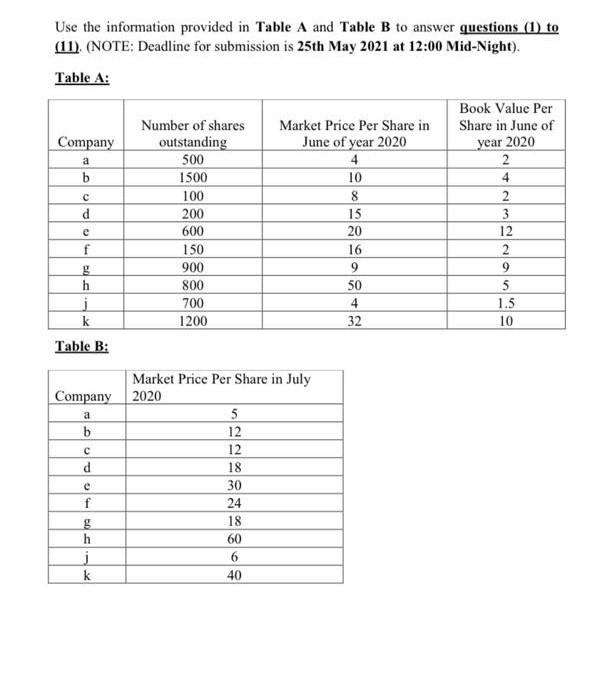

Question: i need the answer quickly year 2020 a 500 4 Use the information provided in Table A and Table B to answer questions (1) to

i need the answer quickly

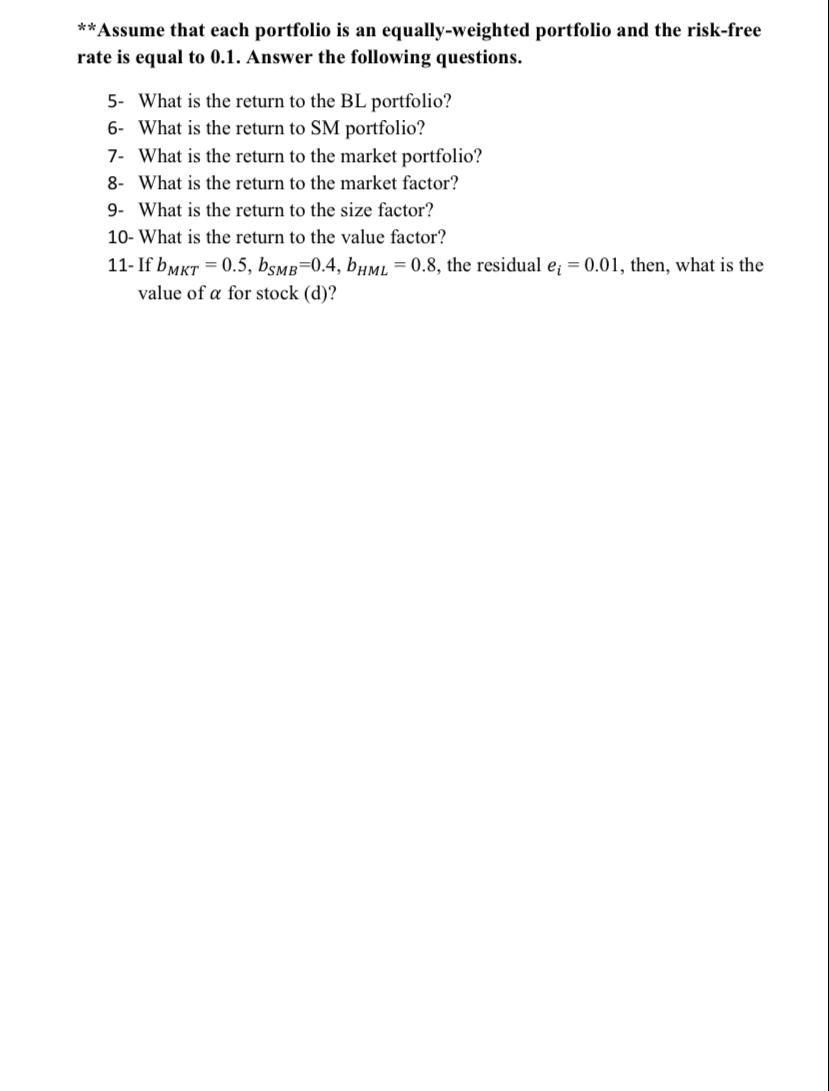

year 2020 a 500 4 Use the information provided in Table A and Table B to answer questions (1) to (11) (NOTE: Deadline for submission is 25th May 2021 at 12:00 Mid-Night). Table A: Book Value Per Number of shares Market Price Per Share in Share in June of Company outstanding June of year 2020 4 2 b 1500 10 100 8 2 d 200 15 3 600 20 12 f 150 16 2 g 900 h 800 50 5 j 700 k 1200 32 10 Table B: C 9 9 4 1.5 a Market Price Per Share in July Company 2020 5 b 12 12 d 18 e 30 f 24 g 18 h 60 j 6 k 40 **Assume that each portfolio is an equally-weighted portfolio and the risk-free rate is equal to 0.1. Answer the following questions. 5. What is the return to the BL portfolio? 6- What is the return to SM portfolio? 7. What is the return to the market portfolio? 8- What is the return to the market factor? 9. What is the return to the size factor? 10- What is the return to the value factor? 11- If bmkt = 0.5, bsme=0.4, bumL = 0.8, the residual e; = 0.01, then, what is the value of a for stock (d)? year 2020 a 500 4 Use the information provided in Table A and Table B to answer questions (1) to (11) (NOTE: Deadline for submission is 25th May 2021 at 12:00 Mid-Night). Table A: Book Value Per Number of shares Market Price Per Share in Share in June of Company outstanding June of year 2020 4 2 b 1500 10 100 8 2 d 200 15 3 600 20 12 f 150 16 2 g 900 h 800 50 5 j 700 k 1200 32 10 Table B: C 9 9 4 1.5 a Market Price Per Share in July Company 2020 5 b 12 12 d 18 e 30 f 24 g 18 h 60 j 6 k 40 **Assume that each portfolio is an equally-weighted portfolio and the risk-free rate is equal to 0.1. Answer the following questions. 5. What is the return to the BL portfolio? 6- What is the return to SM portfolio? 7. What is the return to the market portfolio? 8- What is the return to the market factor? 9. What is the return to the size factor? 10- What is the return to the value factor? 11- If bmkt = 0.5, bsme=0.4, bumL = 0.8, the residual e; = 0.01, then, what is the value of a for stock (d)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts