Question: i need the answer to this question with a clear step by step calculation as soon as possible! thanks! Practice RRA On January 1, 2018,

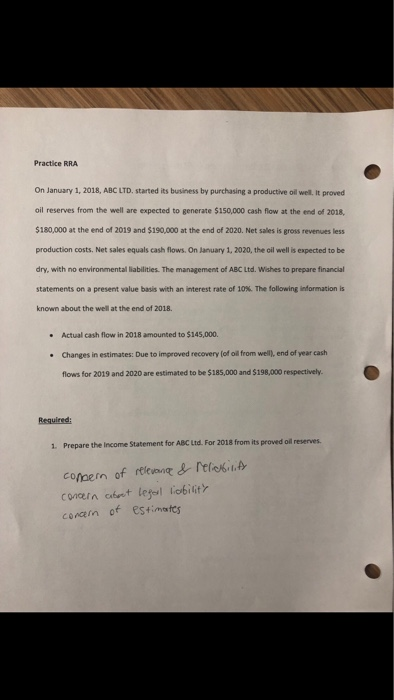

Practice RRA On January 1, 2018, ABC LTD. started its business by purchasing a productive oil well. It proved oil reserves from the well are expected to generate $150,000 cash flow at the end of 2018, $180,000 at the end of 2019 and $190,000 at the end of 2020. Net sales is gross revenues less production costs. Net sales equals cash flows. On January 1, 2020, the oil well is expected to be dry, with no environmental liabilities. The management of ABC Ltd. Wishes to prepare financial statements on a present value basis with an interest rate of 10%. The following information is known about the well at the end of 2018. Actual cash flow in 2018 amounted to $145,000. Changes in estimates: Due to improved recovery of oil from well), end of year cash flows for 2019 and 2020 are estimated to be $185,000 and $198,000 respectively. Required: 1. Prepare the income Statement for ABC Ltd. For 2018 from its proved oil reserves. concern of relevance & reliability concern about legal ability coram of estimates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts