Question: I NEED THE ANSWER WHICH IS PROVIDED WITH THE EXCEL SOLVER CODES. IN EXPLANATION, WE ARE EXPECTED TO SOLVE THIS QUESTION USING EXCEL SOLVER AND

I NEED THE ANSWER WHICH IS PROVIDED WITH THE EXCEL SOLVER CODES. IN EXPLANATION, WE ARE EXPECTED TO SOLVE THIS QUESTION USING EXCEL SOLVER AND PROVIDE THE ANSWER WITH THE EXCEL SOLVER SOLUTIONS. PLEASE ALSO INCLUDE YOUR CODES IN THE EXCEL SOLVER WHILE YOU SHARE YOUR EXACT ANSWER.

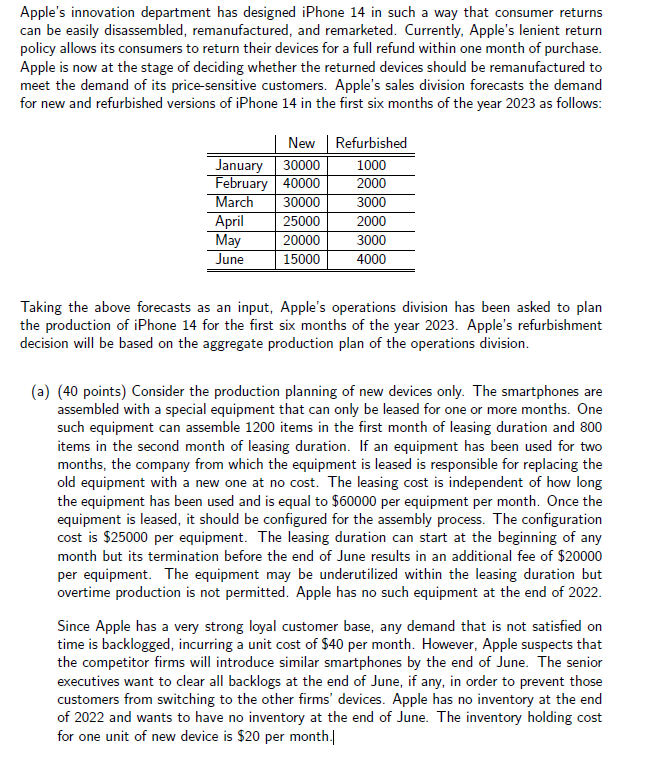

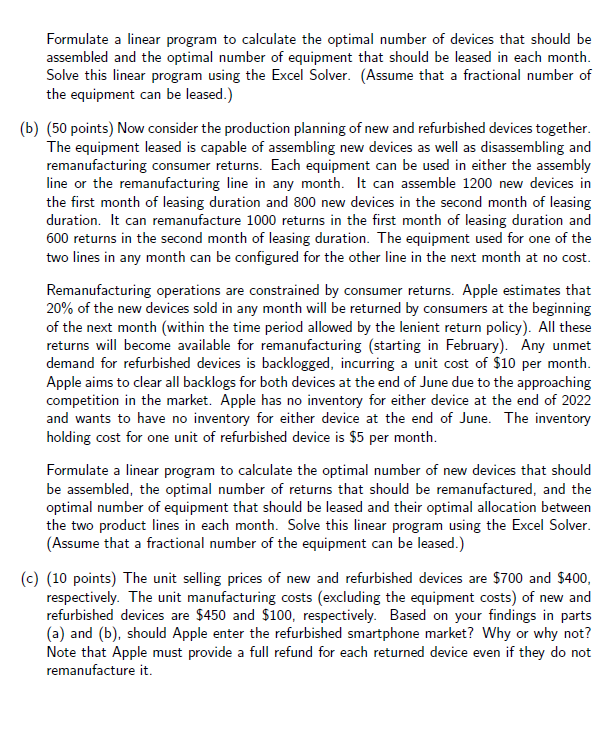

Apple's innovation department has designed iPhone 14 in such a way that consumer returns can be easily disassembled, remanufactured, and remarketed. Currently, Apple's lenient return policy allows its consumers to return their devices for a full refund within one month of purchase. Apple is now at the stage of deciding whether the returned devices should be remanufactured to meet the demand of its price-sensitive customers. Apple's sales division forecasts the demand for new and refurbished versions of iPhone 14 in the first six months of the year 2023 as follows: Taking the above forecasts as an input, Apple's operations division has been asked to plan the production of iPhone 14 for the first six months of the year 2023. Apple's refurbishment decision will be based on the aggregate production plan of the operations division. (a) (40 points) Consider the production planning of new devices only. The smartphones are assembled with a special equipment that can only be leased for one or more months. One such equipment can assemble 1200 items in the first month of leasing duration and 800 items in the second month of leasing duration. If an equipment has been used for two months, the company from which the equipment is leased is responsible for replacing the old equipment with a new one at no cost. The leasing cost is independent of how long the equipment has been used and is equal to $60000 per equipment per month. Once the equipment is leased, it should be configured for the assembly process. The configuration cost is $25000 per equipment. The leasing duration can start at the beginning of any month but its termination before the end of June results in an additional fee of $20000 per equipment. The equipment may be underutilized within the leasing duration but overtime production is not permitted. Apple has no such equipment at the end 2022. Since Apple has a very strong loyal customer base, any demand that is not satisfied on time is backlogged, incurring a unit cost of $40 per month. However, Apple suspects that the competitor firms will introduce similar smartphones by the end of June. The senior executives want to clear all backlogs at the end of June, if any, in order to prevent those customers from switching to the other firms' devices. Apple has no inventory at the end of 2022 and wants to have no inventory at the end of June. The inventory holding cost for one unit of new device is $20 per month.| Formulate a linear program to calculate the optimal number of devices that should be assembled and the optimal number of equipment that should be leased in each month. Solve this linear program using the Excel Solver. (Assume that a fractional number of the equipment can be leased.) b) (50 points) Now consider the production planning of new and refurbished devices together. The equipment leased is capable of assembling new devices as well as disassembling and remanufacturing consumer returns. Each equipment can be used in either the assembly line or the remanufacturing line in any month. It can assemble 1200 new devices in the first month of leasing duration and 800 new devices in the second month of leasing duration. It can remanufacture 1000 returns in the first month of leasing duration and 600 returns in the second month of leasing duration. The equipment used for one of the two lines in any month can be configured for the other line in the next month at no cost. Remanufacturing operations are constrained by consumer returns. Apple estimates that 20% of the new devices sold in any month will be returned by consumers at the beginning of the next month (within the time period allowed by the lenient return policy). All these returns will become available for remanufacturing (starting in February). Any unmet demand for refurbished devices is backlogged, incurring a unit cost of $10 per month. Apple aims to clear all backlogs for both devices at the end of June due to the approaching competition in the market. Apple has no inventory for either device at the end 2022 and wants to have no inventory for either device at the end of June. The inventory holding cost for one unit of refurbished device is $5 per month. Formulate a linear program to calculate the optimal number of new devices that should be assembled, the optimal number of returns that should be remanufactured, and the optimal number of equipment that should be leased and their optimal allocation between the two product lines in each month. Solve this linear program using the Excel Solver. (Assume that a fractional number of the equipment can be leased.) (c) ( 10 points) The unit selling prices of new and refurbished devices are $700 and $400, respectively. The unit manufacturing costs (excluding the equipment costs) of new and refurbished devices are $450 and $100, respectively. Based on your findings in parts (a) and (b), should Apple enter the refurbished smartphone market? Why or why not? Note that Apple must provide a full refund for each returned device even if they do not remanufacture itStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts