Question: I need the answer with correct account title (there are only three that are required), correct debit and credit entries, and an explanation on how

I need the answer with correct account title (there are only three that are required), correct debit and credit entries, and an explanation on how you got the figures. Thank you.

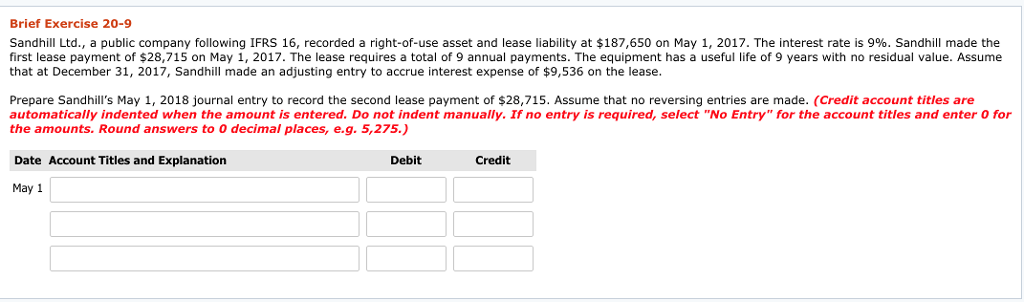

Brief Exercise 20-9 Sandhill Ltd., a public company following IFRS 16, recorded a right-of-use asset and lease liability at $187,650 on May 1, 2017. The interest rate is 9%. Sandhill made the first lease payment of $28,715 on May 1, 2017. The lease requires a total of 9 annual payments. The equipment has a useful life of 9 years with no residual value. Assume that at December 31, 2017, Sandhill made an adjusting entry to accrue interest expense of $9,536 on the lease Prepare Sandhill's May 1, 2018 journal entry to record the second lease payment of $28,715. Assume that no reversing entries are made. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit May 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts