Question: I need the answers please! Solve the following problems and send your paper to LMS by Tuesday, 23 March , 18:00. 1.A father is investing

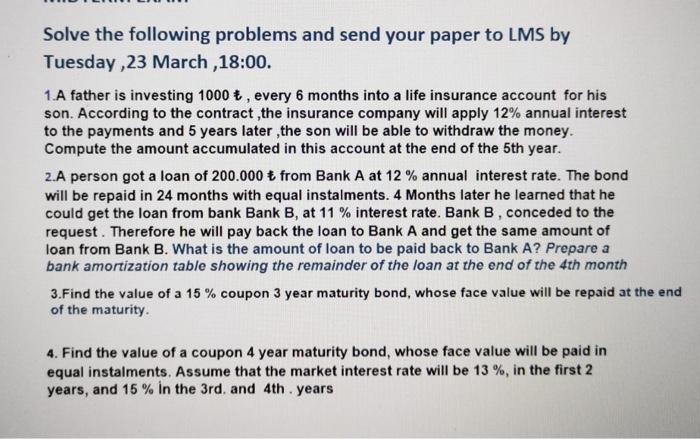

Solve the following problems and send your paper to LMS by Tuesday, 23 March , 18:00. 1.A father is investing 1000 t , every 6 months into a life insurance account for his son. According to the contract , the insurance company will apply 12% annual interest to the payments and 5 years later, the son will be able to withdraw the money. Compute the amount accumulated in this account at the end of the 5th year. 2.A person got a loan of 200.000 from Bank A at 12% annual interest rate. The bond will be repaid in 24 months with equal instalments. 4 Months later he learned that he could get the loan from bank Bank B, at 11 % interest rate. Bank B, conceded to the request. Therefore he will pay back the loan to Bank A and get the same amount of loan from Bank B. What is the amount of loan to be paid back to Bank A? Prepare a bank amortization table showing the remainder of the loan at the end of the 4th month 3.Find the value of a 15% coupon 3 year maturity bond, whose face value will be repaid at the end of the maturity. 4. Find the value of a coupon 4 year maturity bond, whose face value will be paid in equal instalments. Assume that the market interest rate will be 13 %, in the first 2 years, and 15% in the 3rd, and 4th years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts