Question: I need the $answers solved please! Beginning Variable Inventory At 18,750 Units And $693,750 Beginning Absorption Inventory At 18,750 Units. The Following Financial Information Is

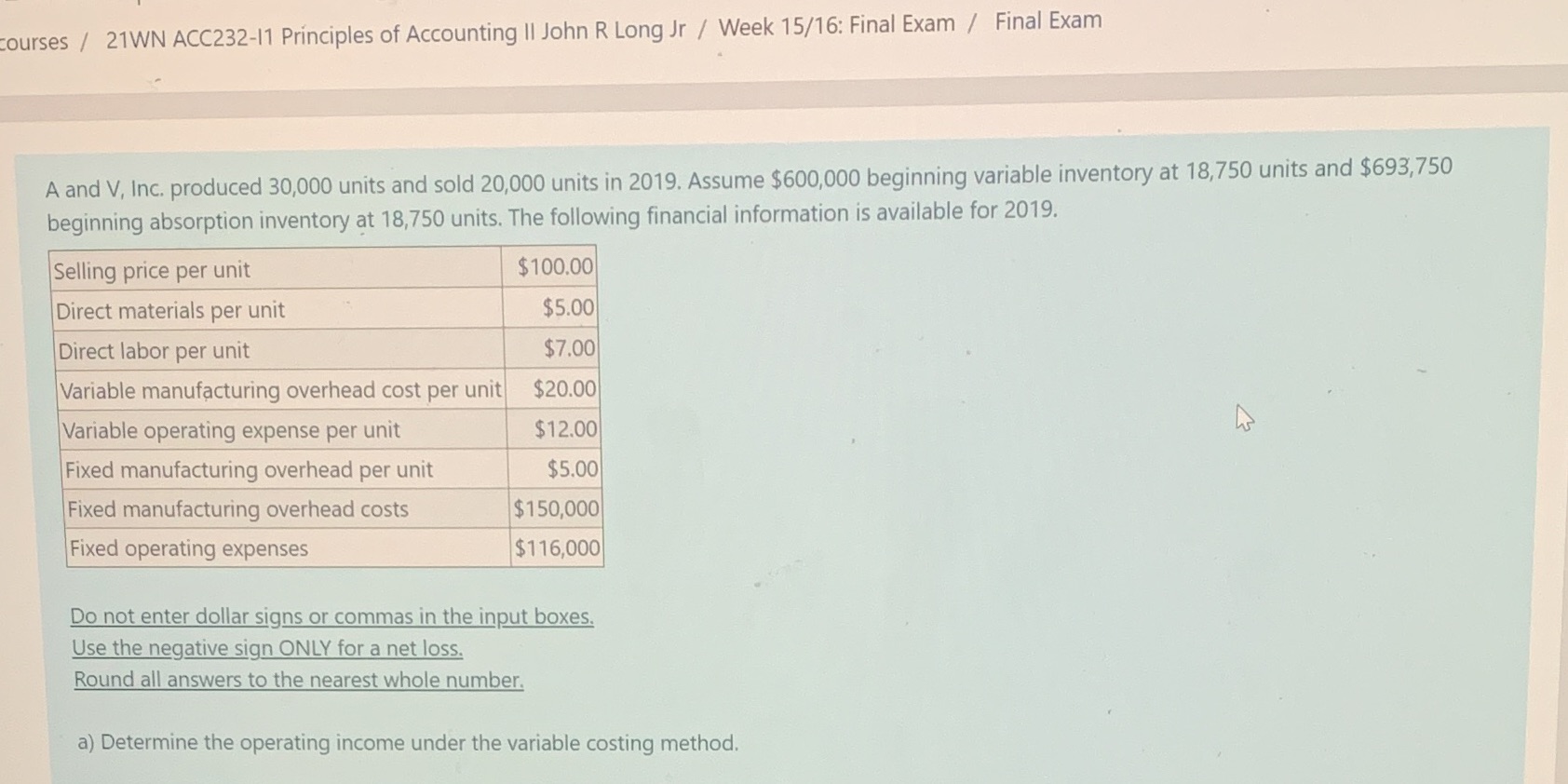

I need the $answers solved please! Beginning Variable Inventory At 18,750 Units And $693,750 Beginning Absorption Inventory At 18,750 Units. The Following Financial Information Is Available For 2019. Selling Price Per Unit $100.00 Direct Materials Per Unit $5.00 Direct Labor Per Unit $7.00 Variable Manufacturing...This problem has been solved!A and V, Inc. produced 30,000 units and sold 20,000 units in 2019. Assume $600,000 beginning variable inventory at 18,750 units and $693,750 beginning absorption inventory at 18,750 units. The following financial information is available for 2019.Selling price per unit $100.00Direct materials per unit $5.00Direct labor per unit $7.00Variable manufacturing overhead cost per unit $20.00Variable operating expense per unit $12.00Fixed manufacturing overhead per unit $5.00Fixed manufacturing overhead costs $150,000Fixed operating expenses $116,000Do not enter dollar signs or commas in the input boxes.Use the negative sign ONLY for a net loss.Round all answers to the nearest whole number.a) Determine the operating income under the variable costing method.Sales $AnswerVariable cost of goods sold: Beginning inventory $Answer Variable cost of goods manufactured $Answer Cost of Goods Available for Sale $Answer Ending inventory $Answer Variable Cost of Goods Sold $Answer Variable Operating Costs $Answer Total Variable Costs $AnswerContribution margin $AnswerFixed costs: Fixed manufacturing overhead $Answer Fixed operating expenses $Answer $AnswerNet income $Answerb) Determine the operating income under the absorption costing method.Sales $AnswerCost of goods sold: Beginning inventory $Answer Variable manufacturing costs $Answer Fixed manufacturing costs $Answer Goods available for sale $Answer Ending inventory $Answer Cost of goods sold $AnswerGross profit $AnswerOperating costs: Variable operating expense per unit $Answer Fixed operating expenses $Answer $AnswerNet income $Answer

courses / 21WN ACC232-11 Principles of Accounting II John R Long Jr / Week 15/16: Final Exam / Final Exam A and V, Inc. produced 30,000 units and sold 20,000 units in 2019. Assume $600,000 beginning variable inventory at 18,750 units and $693,750 beginning absorption inventory at 18,750 units. The following financial information is available for 2019. Selling price per unit $100.00 Direct materials per unit $5.00 Direct labor per unit $7.00 Variable manufacturing overhead cost per unit $20.00 Variable operating expense per unit $12.00 Fixed manufacturing overhead per unit $5.00 Fixed manufacturing overhead costs $150,000 Fixed operating expenses $116,000 Do not enter dollar signs or commas in the input boxes. Use the negative sign ONLY for a net loss. Round all answers to the nearest whole number. a) Determine the operating income under the variable costing method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts