Question: I need the complete and correct solution with all formulas used, even in the excel. Considerthe FTZ Company as discussed in Lecture 5 on Value-at-Risk.

I need the complete and correct solution with all formulas used, even in the excel.

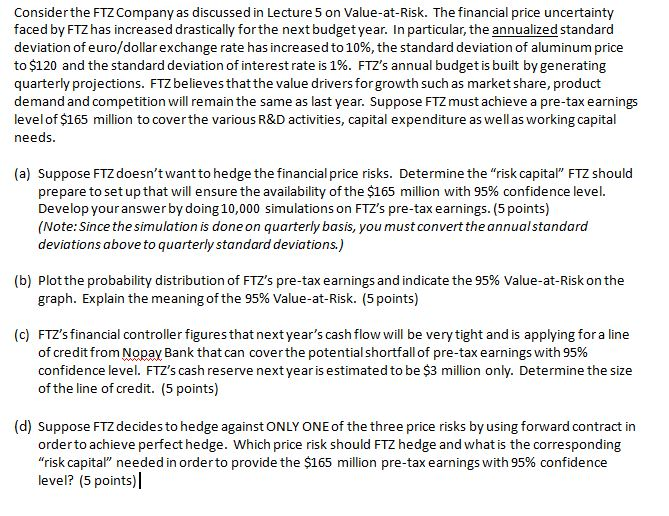

Considerthe FTZ Company as discussed in Lecture 5 on Value-at-Risk. The financial price uncertainty faced by FTZ has increased drastically for the nextbudgetyear. In particular, the annualized standarod deviation of euro/dollar exchange rate has increased to 10%, the standard deviation of aluminum price to $120 and the standard deviation of interest rate is 1%. FTZ's annual budget is built by generating quarterly projections. FTZbelieves thatthe value drivers for growth such as market share, product demand and competition will remain the same as last year. Suppose FTZmust achieve a pre-tax earnings level of $165 million to coverthe various R&D activities, capital expenditure as well as working capital needs (a) Suppose FTZ doesn't wantto hedge the financial price risks. Determine the "risk capital" FTZ should prepare to set up that will ensure the availability of the $165 million with 95% confidence level. Develop your answer by doing10,000 simulations on FTZ's pre-tax earnings. (5 points) (Note: Since the simulation is done on quarterly basis, you must convert the annualstandard deviations above to quarterly standard deviations.) (b) Plot the probability distribution of FTZ's pre-tax earnings and indicate the 95% Value-at-Risk on the graph. Explain the meaning of the 95% Value-at-Risk (5 points) (c) FTZ's financial controller figures that nextyear's cash flow will be very tight and is applying for a line of credit from Nopay Bank that can cover the potential shortfall of pre-tax earnings with 95% confidence level. FTZ's cash reserve nextyear is estimated to be $3 million only. Determine the size of the line of credit. (5 points) (d) Suppose FTZ decides to hedge against ONLY ONE of the three price risks by using forward contract in orderto achieve perfecthedge. Which price risk should FTZ hedge and what is the corresponding "risk capital" needed in orderto provide the $165 million pre-tax earnings with 95% confidence level? (5 points) Considerthe FTZ Company as discussed in Lecture 5 on Value-at-Risk. The financial price uncertainty faced by FTZ has increased drastically for the nextbudgetyear. In particular, the annualized standarod deviation of euro/dollar exchange rate has increased to 10%, the standard deviation of aluminum price to $120 and the standard deviation of interest rate is 1%. FTZ's annual budget is built by generating quarterly projections. FTZbelieves thatthe value drivers for growth such as market share, product demand and competition will remain the same as last year. Suppose FTZmust achieve a pre-tax earnings level of $165 million to coverthe various R&D activities, capital expenditure as well as working capital needs (a) Suppose FTZ doesn't wantto hedge the financial price risks. Determine the "risk capital" FTZ should prepare to set up that will ensure the availability of the $165 million with 95% confidence level. Develop your answer by doing10,000 simulations on FTZ's pre-tax earnings. (5 points) (Note: Since the simulation is done on quarterly basis, you must convert the annualstandard deviations above to quarterly standard deviations.) (b) Plot the probability distribution of FTZ's pre-tax earnings and indicate the 95% Value-at-Risk on the graph. Explain the meaning of the 95% Value-at-Risk (5 points) (c) FTZ's financial controller figures that nextyear's cash flow will be very tight and is applying for a line of credit from Nopay Bank that can cover the potential shortfall of pre-tax earnings with 95% confidence level. FTZ's cash reserve nextyear is estimated to be $3 million only. Determine the size of the line of credit. (5 points) (d) Suppose FTZ decides to hedge against ONLY ONE of the three price risks by using forward contract in orderto achieve perfecthedge. Which price risk should FTZ hedge and what is the corresponding "risk capital" needed in orderto provide the $165 million pre-tax earnings with 95% confidence level? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts