Question: I need the complete and correct solution with all required formulas Question 5: Downside Risk Analysis (20 points) Suppose the mean return and the volatility

I need the complete and correct solution with all required formulas

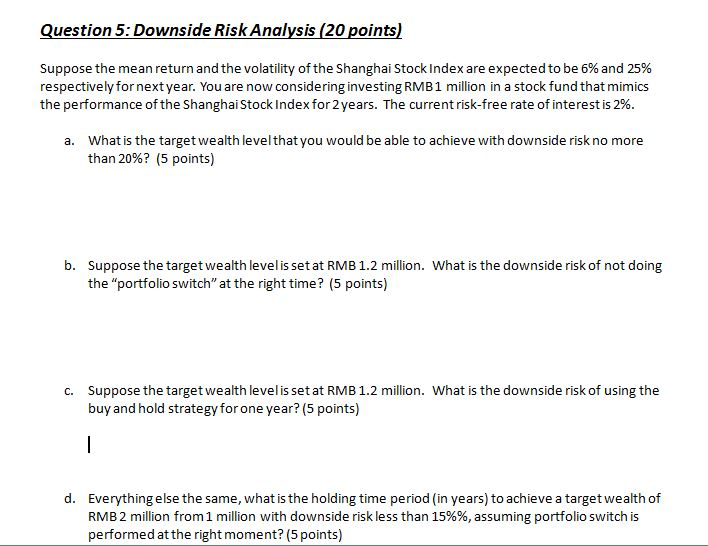

Question 5: Downside Risk Analysis (20 points) Suppose the mean return and the volatility of the Shanghai Stock Index are expected to be 6% and 25% respectively for nextyear. You are now considering investing RMB1 million in a stock fund that mimics the performance of the Shanghai Stock Index for 2 years. The current risk-free rate of interest is 2%. What is the target wealth level that you would be able to achieve with downside risk no more than 20%? (5 points) a. b. Suppose the target wealth level is set at RMB 1.2 million. What is the downside risk of not doing the "portfolio switch" at the right time? (5 points) Suppose the target wealth levelis set at RMB 1.2 million. What is the downside risk of using the buy and hold strategy for one year? (5 points) c. d. Everything else the same, what is the holding time period (in years) to achieve a targetwealth of RMB 2 million from 1 million with downside risk less than 15%%, assuming portfolio switch is performed at the right moment? (5 points) Question 5: Downside Risk Analysis (20 points) Suppose the mean return and the volatility of the Shanghai Stock Index are expected to be 6% and 25% respectively for nextyear. You are now considering investing RMB1 million in a stock fund that mimics the performance of the Shanghai Stock Index for 2 years. The current risk-free rate of interest is 2%. What is the target wealth level that you would be able to achieve with downside risk no more than 20%? (5 points) a. b. Suppose the target wealth level is set at RMB 1.2 million. What is the downside risk of not doing the "portfolio switch" at the right time? (5 points) Suppose the target wealth levelis set at RMB 1.2 million. What is the downside risk of using the buy and hold strategy for one year? (5 points) c. d. Everything else the same, what is the holding time period (in years) to achieve a targetwealth of RMB 2 million from 1 million with downside risk less than 15%%, assuming portfolio switch is performed at the right moment? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts