Question: I need the correct answer for the red outlined box on the last part. Thanks On June 30, 2020, Cullumber Limited issued $2 million of

I need the correct answer for the red outlined box on the last part. Thanks

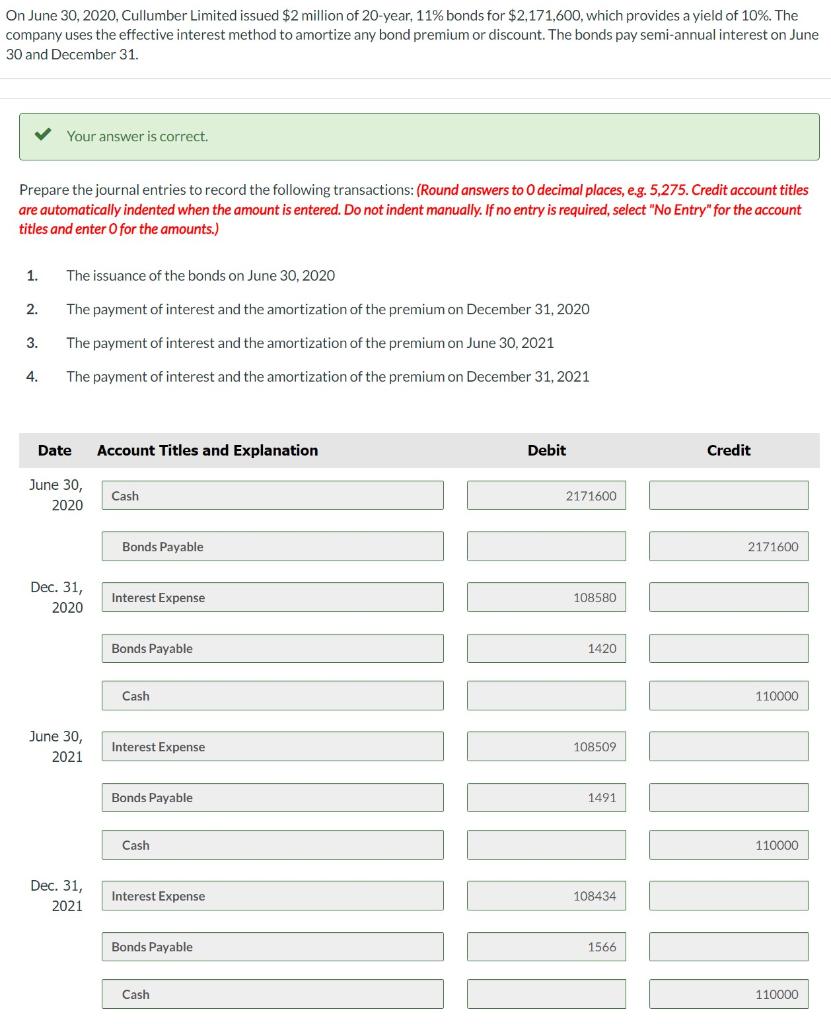

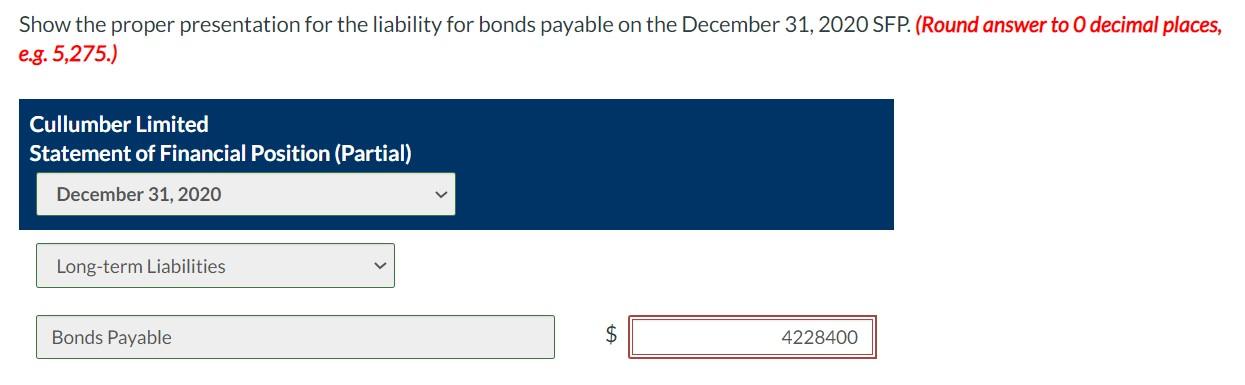

On June 30, 2020, Cullumber Limited issued $2 million of 20-year, 11% bonds for $2.171,600, which provides a yield of 10%. The company uses the effective interest method to amortize any bond premium or discount. The bonds pay semi-annual interest on June 30 and December 31. Your answer is correct. Prepare the journal entries to record the following transactions: (Round answers to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry"for the account titles and enter O for the amounts.) 1. The issuance of the bonds on June 30, 2020 2. The payment of interest and the amortization of the premium on December 31, 2020 3. The payment of interest and the amortization of the premium on June 30, 2021 4. The payment of interest and the amortization of the premium on December 31, 2021 Date Account Titles and Explanation Debit Credit June 30, 2020 Cash 2171600 Bonds Payable 2171600 Dec. 31, 2020 Interest Expense 108580 Bonds Payable 1420 Cash 110000 June 30, 2021 Interest Expense 108509 Bonds Payable 1491 Cash 110000 Dec. 31, 2021 Interest Expense 108434 Bonds Payable 1566 Cash 110000 Show the proper presentation for the liability for bonds payable on the December 31, 2020 SFP. (Round answer to 0 decimal places, e.g. 5,275.) Cullumber Limited Statement of Financial Position (Partial) December 31, 2020 Long-term Liabilities Bonds Payable $ 4228400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts