Question: I need the excel formulas! Chapter Question 4 Input area: Annual coupon rate Settlement date Maturity date Coupons per year Bond price (% of par)

I need the excel formulas!

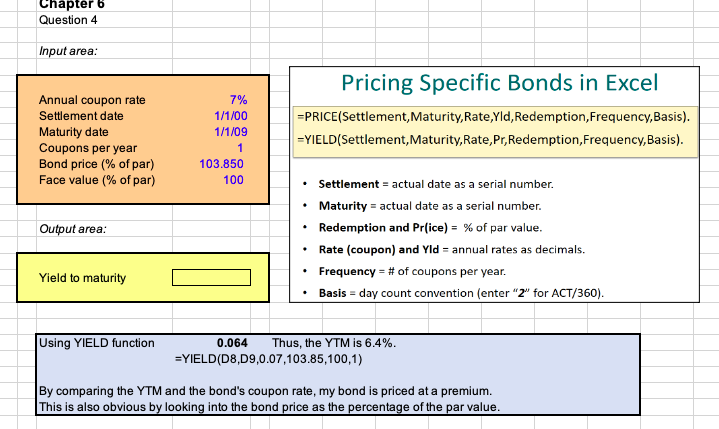

Chapter Question 4 Input area: Annual coupon rate Settlement date Maturity date Coupons per year Bond price (% of par) Face value (% of par) 7% 1/1/00 1/1/09 1 103.850 100 Pricing Specific Bonds in Excel =PRICE(Settlement, Maturity, Rate Yld, Redemption, Frequency, Basis). =YIELD(Settlement, Maturity, Rate, Pr, Redemption, Frequency, Basis). . Output area: Settlement = actual date as a serial number. Maturity = actual date as a serial number. Redemption and Pr(ice) = % of par value. Rate (coupon) and Yid = annual rates as decimals. Frequency = # of coupons per year. Basis = day count convention (enter "2" for ACT/360). . . = Yield to maturity Using YIELD function 0.064 Thus, the YTM is 6.4%. =YIELD(D8,09,0.07,103.85,100,1) By comparing the YTM and the bond's coupon rate, my bond is priced at a premium. This is also obvious by looking into the bond price as the percentage of the par value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts