Question: I need the excel formulas for this. Question 6 Input area: Settlement date Maturity date Coupon rate Coupons per year Yield to maturity Face value

I need the excel formulas for this.

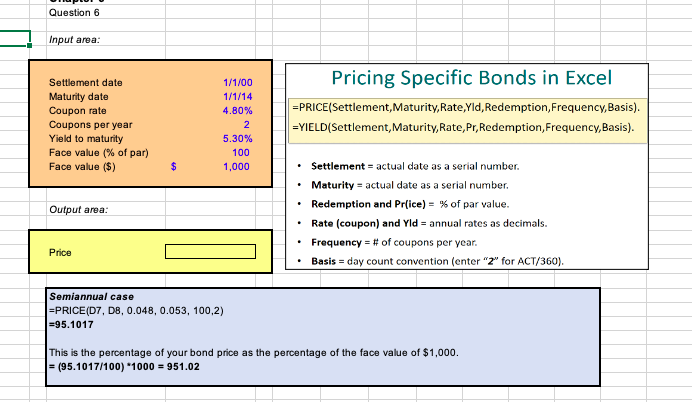

Question 6 Input area: Settlement date Maturity date Coupon rate Coupons per year Yield to maturity Face value (% of par) Face value ($) 1/1/00 1/1/14 4.80% 2 5.30% 100 1,000 Pricing Specific Bonds in Excel =PRICE(Settlement, Maturity, Rate, Yld, Redemption, Frequency,Basis). =YIELD(Settlement , Maturity, Rate, Pr, Redemption, Frequency,Basis). $ Output area: Settlement = actual date as a serial number. Maturity = actual date as a serial number. Redemption and Pr(ice) = % of par value. Rate (coupon) and Yld = annual rates as decimals. Frequency = # of coupons per year. Basis = day count convention (enter "2" for ACT/360). . Price Semiannual case =PRICE(D7, DB, 0.048, 0.053, 100,2) =95.1017 This is the percentage of your bond price as the percentage of the face value of $1,000. = (95.1017/100) 1000 = 951.02

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts