Question: i need the final answer Question 4 Janis Corporation bought equipment for $60,000 on January 1, 2016. Janis estimated the useful life to be 3

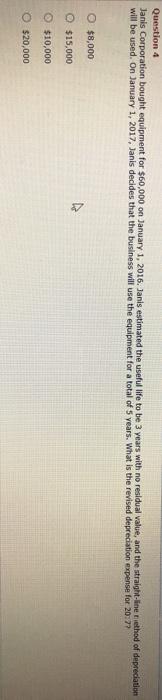

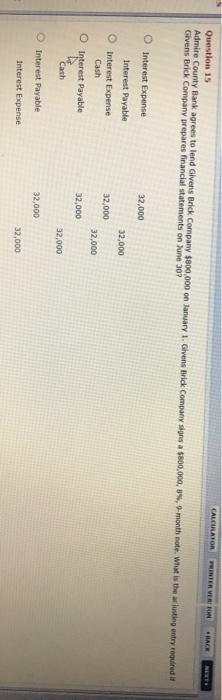

Question 4 Janis Corporation bought equipment for $60,000 on January 1, 2016. Janis estimated the useful life to be 3 years with no residual value, and the straight-line method of depreciation will be used. On January 1, 2017, Janis decides that the business will use the equipment for a total of 5 years. What is the revised depreciation expense for 20:7 $8,000 O $15,000 $10,000 O $20,000 CALCULATOR TERVER BE NETE Question 15 Admire County Bank agrees to lend Givens Brick Company $800,000 on January 1. Given trick Company signs a $800,000,-month note. What is the lusting entry required Givens Brick Company prepares financial statements on June 307 O Interest Expense 32,000 32,000 Interest Payable Interest Expense Cash O Interest Payable Interest 32,000 32,000 32,000 Cash 32,000 Interest Payable 32,000 Interest Expense 32,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts