Question: I need the formula for the excel please. Use the following information for the remaining questions. Ann would like to buy a house. It costs

I need the formula for the excel please.

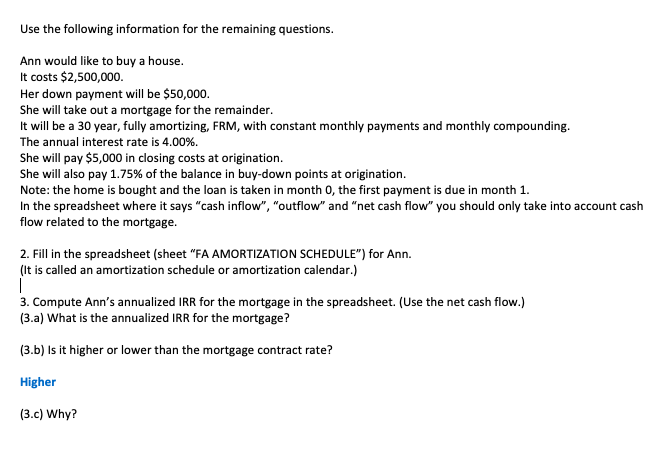

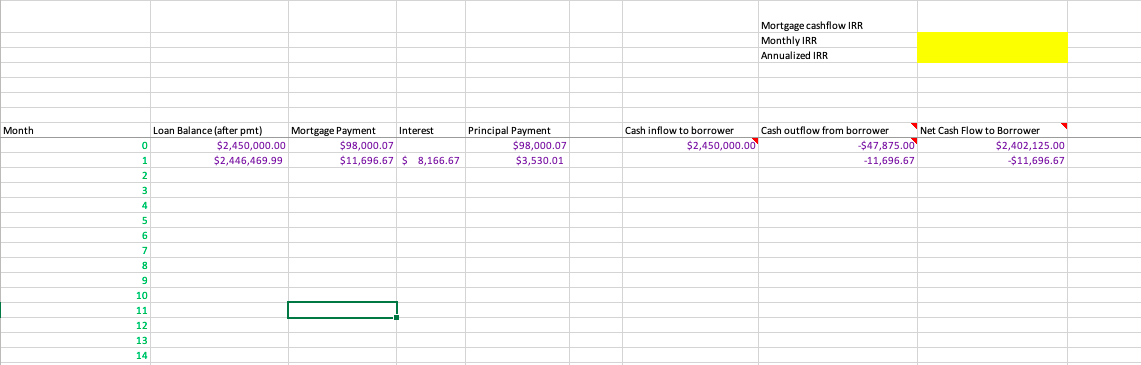

Use the following information for the remaining questions. Ann would like to buy a house. It costs $2,500,000. Her down payment will be $50,000. She will take out a mortgage for the remainder. It will be a 30 year, fully amortizing, FRM, with constant monthly payments and monthly compounding. The annual interest rate is 4.00%. She will pay $5,000 in closing costs at origination. She will also pay 1.75% of the balance in buy-down points at origination. Note: the home is bought and the loan is taken in month 0 , the first payment is due in month 1. In the spreadsheet where it says "cash inflow", "outflow" and "net cash flow" you should only take into account c flow related to the mortgage. Mortgage cashflow IRR Monthly IRR Annualized IRR Month Use the following information for the remaining questions. Ann would like to buy a house. It costs $2,500,000. Her down payment will be $50,000. She will take out a mortgage for the remainder. It will be a 30 year, fully amortizing, FRM, with constant monthly payments and monthly compounding. The annual interest rate is 4.00%. She will pay $5,000 in closing costs at origination. She will also pay 1.75% of the balance in buy-down points at origination. Note: the home is bought and the loan is taken in month 0 , the first payment is due in month 1. In the spreadsheet where it says "cash inflow", "outflow" and "net cash flow" you should only take into account c flow related to the mortgage. Mortgage cashflow IRR Monthly IRR Annualized IRR Month

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts