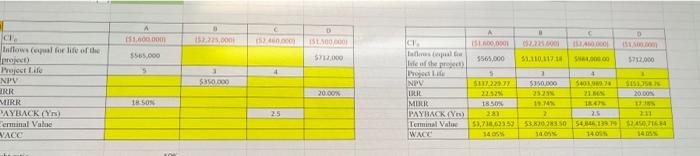

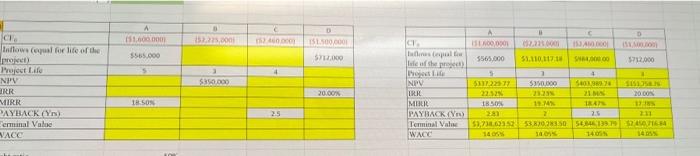

Question: i need the formulas for the chart on the left. the chart on yhe right contains the corrrect answers, but not the functions i need

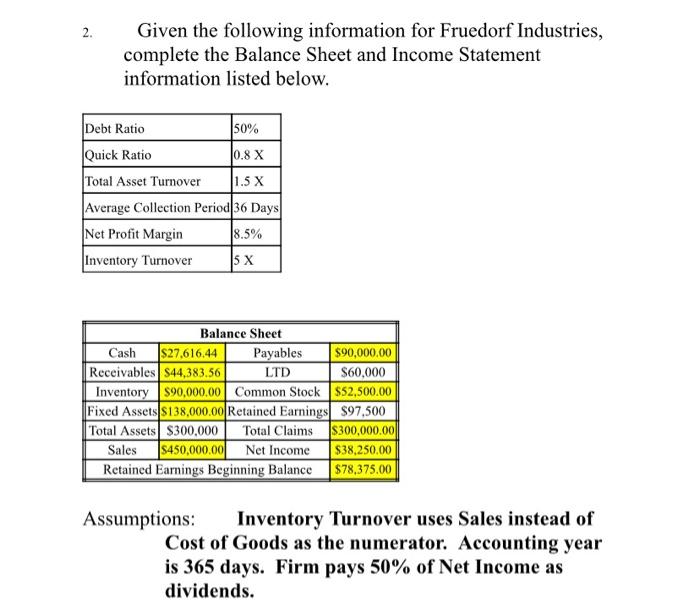

A 151,00 D 151.500.000 3 D 152.000 1000 1000 CI Dallas ST1000 5565.000 5 SNA000.00 5712.000 2.300 53.110.117:14 1 $250.000 4 1 CH indows (equal for life of the projet Project Life NPV BRR MIRR AYBACK (Y eminal Value VACC S350.000 Lood NP BONS VEZ 5565,000 5 $111.22 22:52 185 23 51,738,693 1406 1 SESSEN 20.00 20.00% NOST SUCE WWE 2.5 2 2.5 111 MIR PAYBACK (1) Terminal Value WACO A SE OSERCONES 180 140 A 151.000.000 152.275.000 20 D 151.500.000 100 DO Coro ST1000 Dans 5565.000 5 4 + $350.000 CH Indlows us for life of the projet Iroject Life NPN BRR MIRR PAYBACK (Y erminal Value VACC |hoos NP D 12.30 ALDO 5565.000 31.10.11 SA0000 5712.000 5 1 50 22:52 20.00 185 1.MN TAN 21 26 51.253.10.20150SU13797654 1406 100 14.00 LESTIES COOKIES 20.00% 18 SON W 2.5 MIRR PAYBACKY Terminal Value WACO 2. Given the following information for Fruedorf Industries, complete the Balance Sheet and Income Statement information listed below. Debt Ratio 50% Quick Ratio 0.8 X Total Asset Turnover 1.5 X Average Collection Period 36 Days Net Profit Margin 8.5% Inventory Turnover 5 X Balance Sheet Cash $27.616.44 Payables $90,000.00 Receivables S44,383.56 LTD $60,000 Inventory S90,000.00 Common Stock $52,500.00 Fixed Assets 5138,000.00 Retained Earnings $97,500 Total Assets $300,000 Total Claims $300,000.00 Sales S450,000.00 Net Income $38,250.00 Retained Earnings Beginning Balance $78,375.00 Assumptions: Inventory Turnover uses Sales instead of Cost of Goods as the numerator. Accounting year is 365 days. Firm pays 50% of Net Income as dividends. A 151,00 D 151.500.000 3 D 152.000 1000 1000 CI Dallas ST1000 5565.000 5 SNA000.00 5712.000 2.300 53.110.117:14 1 $250.000 4 1 CH indows (equal for life of the projet Project Life NPV BRR MIRR AYBACK (Y eminal Value VACC S350.000 Lood NP BONS VEZ 5565,000 5 $111.22 22:52 185 23 51,738,693 1406 1 SESSEN 20.00 20.00% NOST SUCE WWE 2.5 2 2.5 111 MIR PAYBACK (1) Terminal Value WACO A SE OSERCONES 180 140 A 151.000.000 152.275.000 20 D 151.500.000 100 DO Coro ST1000 Dans 5565.000 5 4 + $350.000 CH Indlows us for life of the projet Iroject Life NPN BRR MIRR PAYBACK (Y erminal Value VACC |hoos NP D 12.30 ALDO 5565.000 31.10.11 SA0000 5712.000 5 1 50 22:52 20.00 185 1.MN TAN 21 26 51.253.10.20150SU13797654 1406 100 14.00 LESTIES COOKIES 20.00% 18 SON W 2.5 MIRR PAYBACKY Terminal Value WACO 2. Given the following information for Fruedorf Industries, complete the Balance Sheet and Income Statement information listed below. Debt Ratio 50% Quick Ratio 0.8 X Total Asset Turnover 1.5 X Average Collection Period 36 Days Net Profit Margin 8.5% Inventory Turnover 5 X Balance Sheet Cash $27.616.44 Payables $90,000.00 Receivables S44,383.56 LTD $60,000 Inventory S90,000.00 Common Stock $52,500.00 Fixed Assets 5138,000.00 Retained Earnings $97,500 Total Assets $300,000 Total Claims $300,000.00 Sales S450,000.00 Net Income $38,250.00 Retained Earnings Beginning Balance $78,375.00 Assumptions: Inventory Turnover uses Sales instead of Cost of Goods as the numerator. Accounting year is 365 days. Firm pays 50% of Net Income as dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts