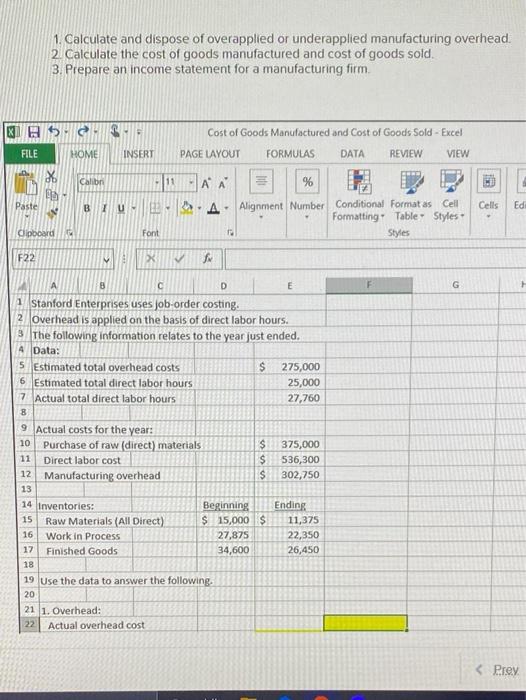

Question: i need the formulas inserted into excel and what values you used to compute it 1. Calculate and dispose of overapplied or underapplied manufacturing overhead.

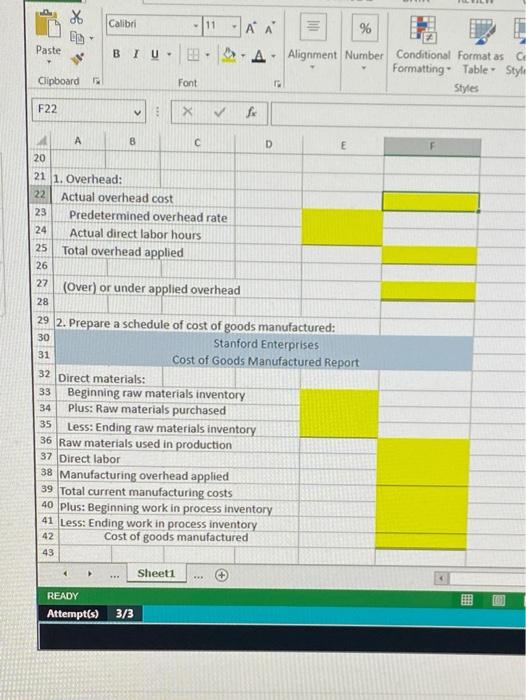

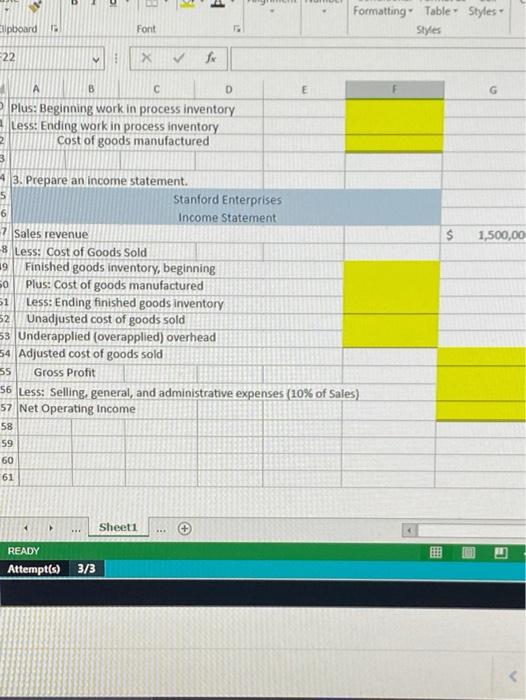

1. Calculate and dispose of overapplied or underapplied manufacturing overhead. 2 Calculate the cost of goods manufactured and cost of goods sold. 3. Prepare an income statement for a manufacturing firm. HS Cost of Goods Manufactured and Cost of Goods Sold - Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Calibri X 20 11 Paste B1 UM EL A A % A Alignment Number Conditional Format as Cell Formatting Table Styles 18 Styles Cells Ed Gipboard Font F22 > G B D E 1 Stanford Enterprises uses job-order costing. 2 Overhead is applied on the basis of direct labor hours. The following information relates to the year just ended. 4 Data: 5 Estimated total overhead costs $ 275,000 6 Estimated total direct labor hours 25,000 7 Actual total direct labor hours 27,760 8 9 Actual costs for the year: 10 Purchase of raw (direct) materials 11 Direct labor cost 12 Manufacturing overhead $ $ $ 375,000 536,300 302,750 13 Ending 11,375 22,350 26,450 14 Inventories: Beginning 15 Raw Materials (All Direct) $ 15,000 $ 16 Work in Process 27,875 17 Finished Goods 34,600 18 19 Use the data to answer the following. 20 21 1. Overhead: 22 Actual overhead cost >A - Alignment Number Conditional Format as a Formatting Table Style Font Styles Clipboard F22 V 3 X 8 D E 20 33 21 1. Overhead: 22 Actual overhead cost 23 Predetermined overhead rate 24 Actual direct labor hours 25 Total overhead applied 26 27 (Over) or under applied overhead 28 29 2. Prepare a schedule of cost of goods manufactured: 30 Stanford Enterprises 31 Cost of Goods Manufactured Report 32 Direct materials: Beginning raw materials inventory 34 Plus: Raw materials purchased 35 Less: Ending raw materials inventory 36 Raw materials used in production 37 Direct labor 38 Manufacturing overhead applied 39 Total current manufacturing costs 40 Plus: Beginning work in process inventory 41 Less: Ending work in process inventory 42 Cost of goods manufactured 43 Sheet1 READY Attempt(s) 3/3 Formatting Table Styles Styles pboard Font =22 X fx G 2 $ 1,500,00 B D E Plus: Beginning work in process inventory Less: Ending work in process inventory Cost of goods manufactured 3 43. Prepare an income statement. Stanford Enterprises 6 Income Statement 7 Sales revenue -8 Less: Cost of Goods Sold 19 Finished goods inventory, beginning Plus: Cost of goods manufactured 51 Less: Ending finished goods inventory 52 Unadjusted cost of goods sold 53 Underapplied (overapplied) overhead 54 Adjusted cost of goods sold Gross Profit 56 Less: Selling, general, and administrative expenses (10% of Sales) 57 Net Operating Income 58 59 60 61 50 55 Sheet1 READY Attempt(s) E ED 3/3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts