Question: I need the full calculations in Excel so I can learn how to do it myself. Thank you! Suppose BMI Regional is considering the purchase

I need the full calculations in Excel so I can learn how to do it myself. Thank you!

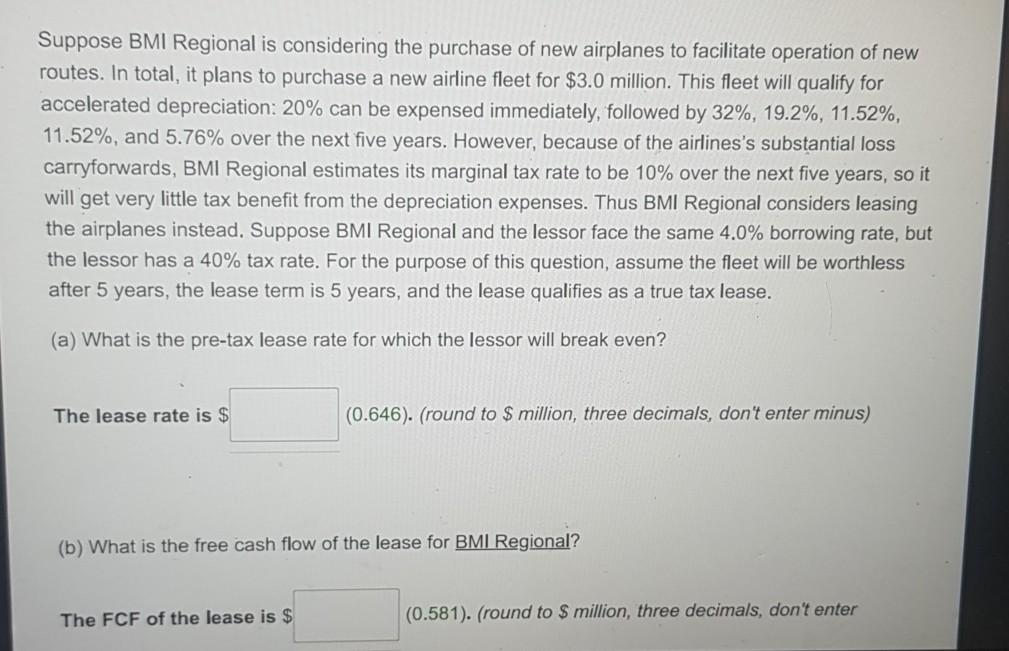

Suppose BMI Regional is considering the purchase of new airplanes to facilitate operation of new routes. In total, it plans to purchase a new airline fleet for $3.0 million. This fleet will qualify for accelerated depreciation: 20% can be expensed immediately, followed by 32%, 19.2%, 11.52%, 11.52%, and 5.76% over the next five years. However, because of the airlines's substantial loss carryforwards, BMI Regional estimates its marginal tax rate to be 10% over the next five years, so it will get very little tax benefit from the depreciation expenses. Thus BMI Regional considers leasing the airplanes instead. Suppose BMI Regional and the lessor face the same 4.0% borrowing rate, but the lessor has a 40% tax rate. For the purpose of this question, assume the fleet will be worthless after 5 years, the lease term is 5 years, and the lease qualifies as a true tax lease. (a) What is the pre-tax lease rate for which the lessor will break even? The lease rate is $ (0.646). (round to $ million, three decimals, don't enter minus) (b) What is the free cash flow of the lease for BMI Regional? The FCF of the lease is $ (0.581). (round to $ million, three decimals, don't enter Suppose BMI Regional is considering the purchase of new airplanes to facilitate operation of new routes. In total, it plans to purchase a new airline fleet for $3.0 million. This fleet will qualify for accelerated depreciation: 20% can be expensed immediately, followed by 32%, 19.2%, 11.52%, 11.52%, and 5.76% over the next five years. However, because of the airlines's substantial loss carryforwards, BMI Regional estimates its marginal tax rate to be 10% over the next five years, so it will get very little tax benefit from the depreciation expenses. Thus BMI Regional considers leasing the airplanes instead. Suppose BMI Regional and the lessor face the same 4.0% borrowing rate, but the lessor has a 40% tax rate. For the purpose of this question, assume the fleet will be worthless after 5 years, the lease term is 5 years, and the lease qualifies as a true tax lease. (a) What is the pre-tax lease rate for which the lessor will break even? The lease rate is $ (0.646). (round to $ million, three decimals, don't enter minus) (b) What is the free cash flow of the lease for BMI Regional? The FCF of the lease is $ (0.581). (round to $ million, three decimals, don't enter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts