Question: I need the function/cell equations on how you got the answer Kroger Required Return = Question 6) begin{tabular}{|l|l|l|} cline { 2 - 3 } multicolumn{1}{l|}{}

I need the function/cell equations on how you got the answer

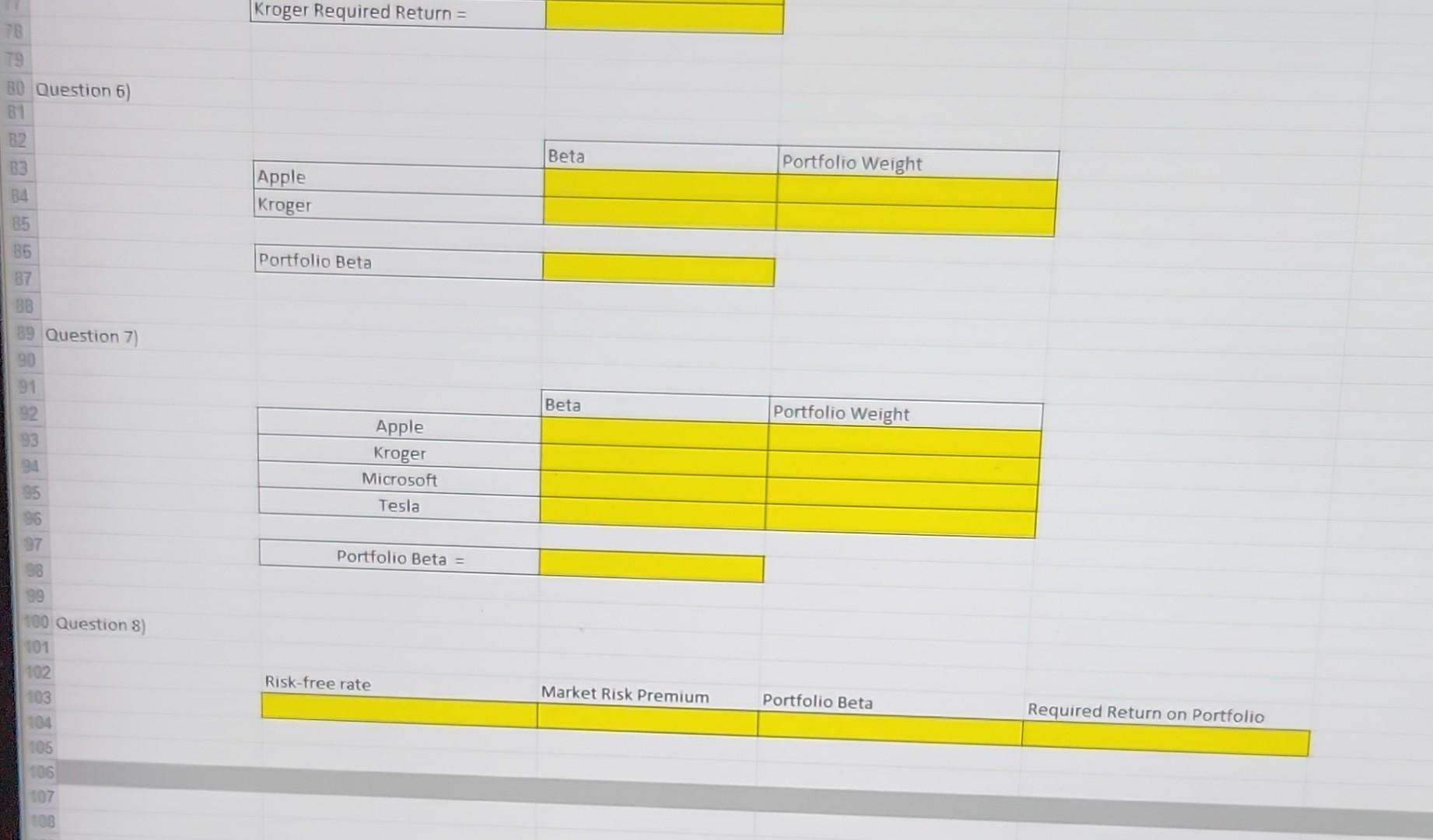

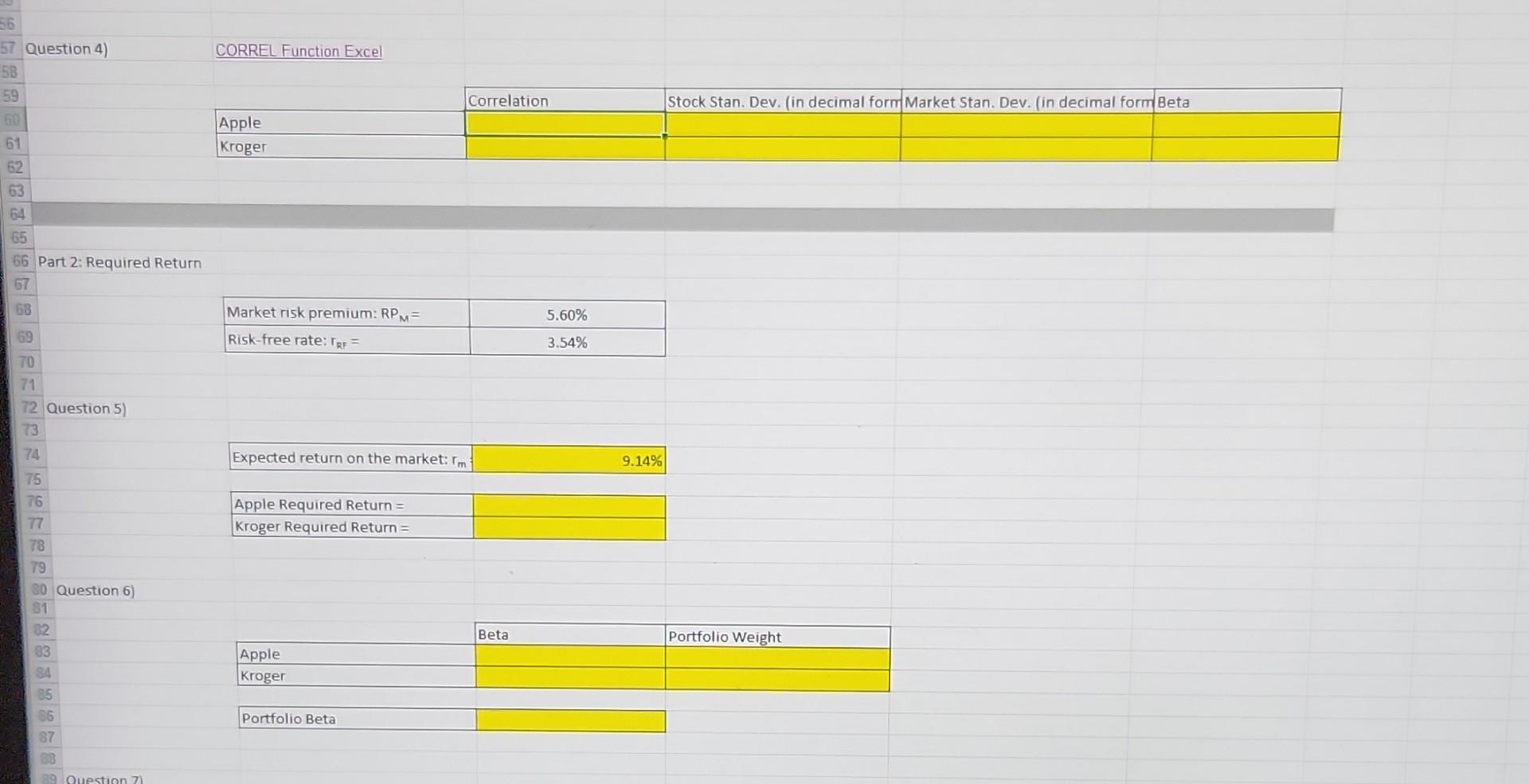

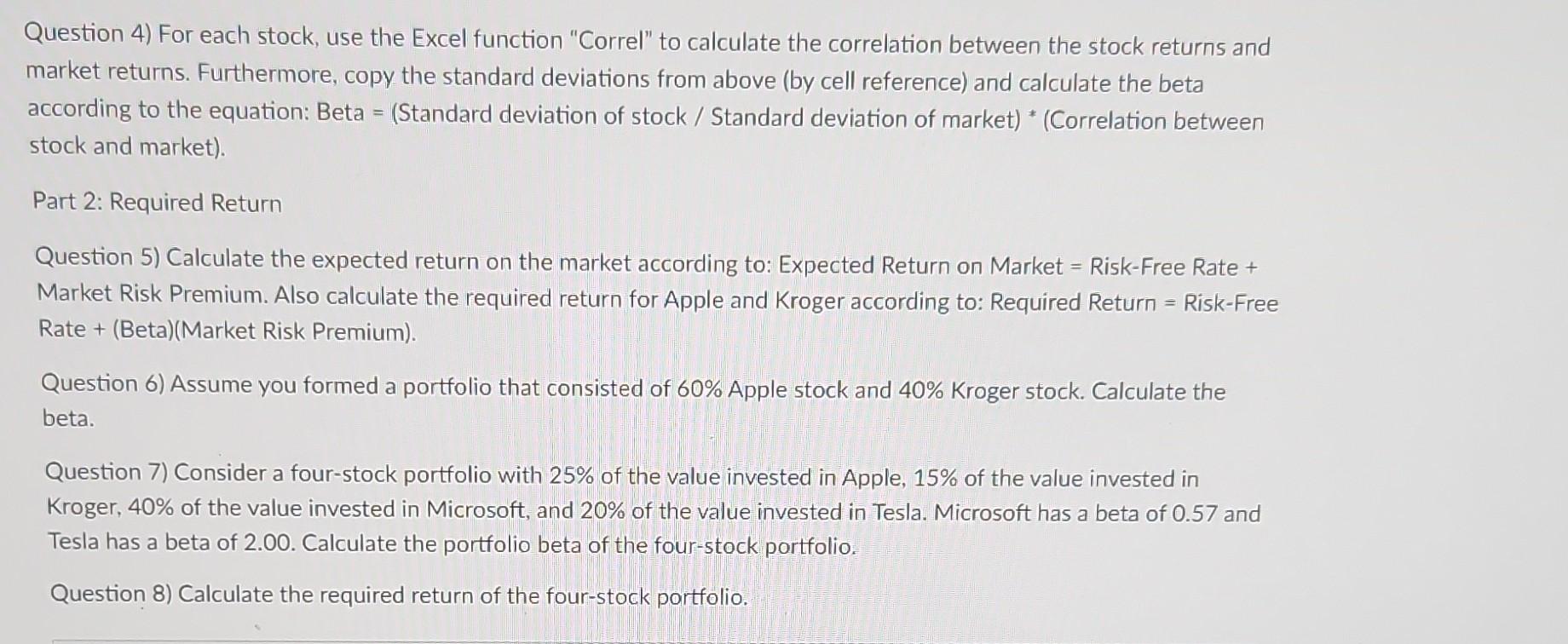

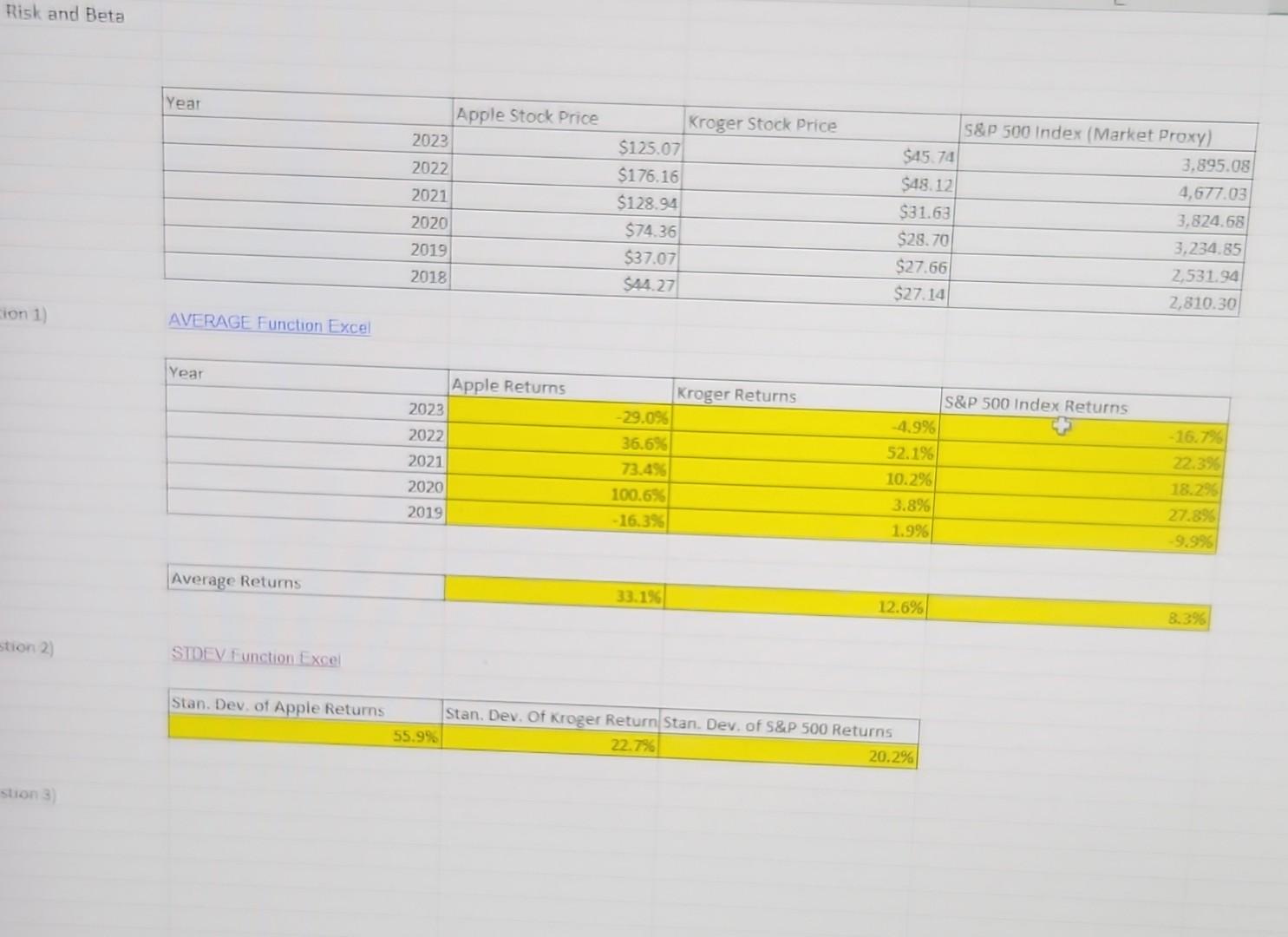

Kroger Required Return = Question 6) \begin{tabular}{|l|l|l|} \cline { 2 - 3 } \multicolumn{1}{l|}{} & Beta & Portfolio Weight \\ \hline Apple & & \\ \hline Kroger & & \\ \hline \end{tabular} Question 7) \begin{tabular}{|c|c|l|} \cline { 2 - 3 } & Beta & Portfolio Weight \\ \hline Apple & & \\ \hline Kroger & & \\ \hline Microsoft & & \\ \hline Tesla & & \\ \hline \end{tabular} Question 8) Portfolio Beta = \begin{tabular}{|l|l|l|l} Risk-free rate & Market Risk Premium Portfolio Beta & Required Return on Portfolio \\ \hline & & \end{tabular} Part 2: Required Return Question 4) For each stock, use the Excel function "Correl" to calculate the correlation between the stock returns and market returns. Furthermore, copy the standard deviations from above (by cell reference) and calculate the beta according to the equation: Beta = (Standard deviation of stock / Standard deviation of market) * (Correlation between stock and market). Part 2: Required Return Question 5) Calculate the expected return on the market according to: Expected Return on Market = Risk-Free Rate + Market Risk Premium. Also calculate the required return for Apple and Kroger according to: Required Return = Risk-Free Rate +( Beta) ( Market Risk Premium) Question 6) Assume you formed a portfolio that consisted of 60% Apple stock and 40% Kroger stock. Calculate the beta. Question 7) Consider a four-stock portfolio with 25% of the value invested in Apple, 15% of the value invested in Kroger, 40% of the value invested in Microsoft, and 20% of the value invested in Tesla. Microsoft has a beta of 0.57 and Tesla has a beta of 2.00. Calculate the portfolio beta of the four-stock portfolio. Question 8) Calculate the required return of the four-stock portfolio. Fisk and Beta

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts