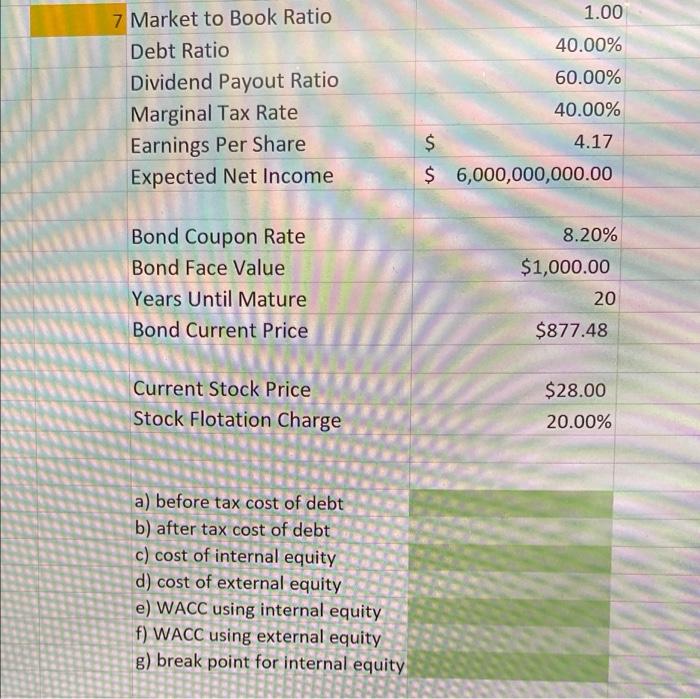

Question: i need the green cells solved for using the informstion above. i need the formulas to input in excel as well 1.00 40.00% 60.00% 7

1.00 40.00% 60.00% 7 Market to Book Ratio Debt Ratio Dividend Payout Ratio Marginal Tax Rate Earnings Per Share Expected Net Income 40.00% 4.17 $ $ 6,000,000,000.00 8.20% $1,000.00 Bond Coupon Rate Bond Face Value Years Until Mature Bond Current Price 20 $877.48 Current Stock Price Stock Flotation Charge $28.00 20.00% a) before tax cost of debt b) after tax cost of debt c) cost of internal equity d) cost of external equity e) WACC using internal equity f) WACC using external equity g) break point for internal equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts