Question: i need the incorrect answer In practice, a common way to value a share of stock when a company pays dividends is to value the

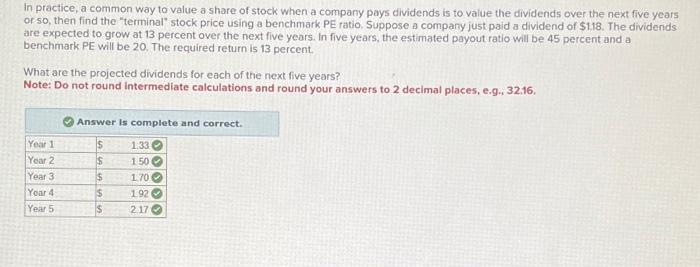

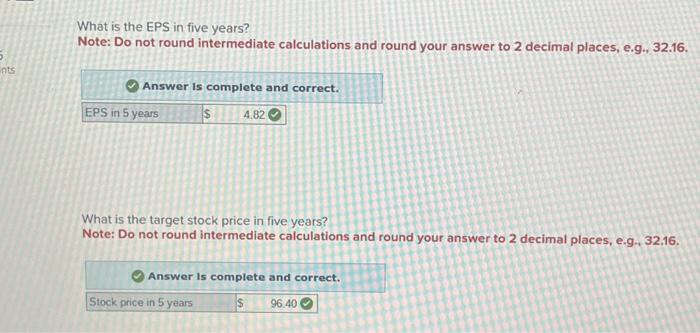

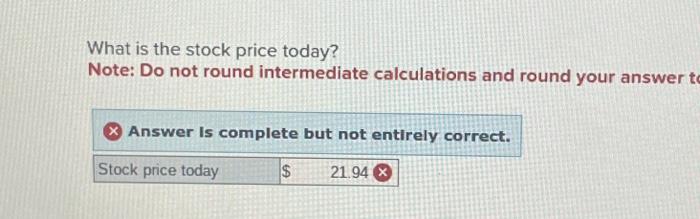

In practice, a common way to value a share of stock when a company pays dividends is to value the dividends over the next five years or so, then find the "terminal" stock price using a benchmark PE ratio, Suppose a company just paid a dividend of \$1tis. The dividenids are expected to grow at 13 percent over the next five years. In five years, the estimated payout ratio will be 45 percent and a benchmark PE will be 20 . The required return is 13 percent. What are the projected dividends for each of the next five years? Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.9., 32.16 . Answer is complete and correct. What is the stock price today? Note: Do not round intermediate calculations and round your answer Answer is complete but not entirely correct. What is the EPS in five years? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Answer is complete and correct. What is the target stock price in five years? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts