Question: I need the problem explained. I never got a true grasp on where these answers are supposed to come from. Chapter 10 Exercise Problem McGee

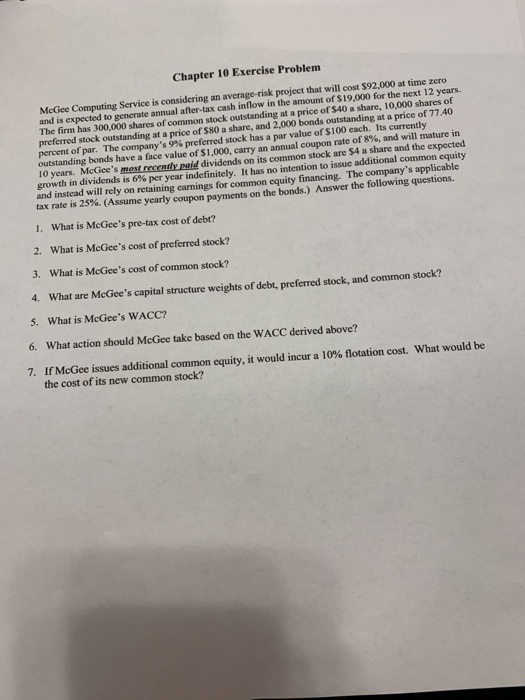

Chapter 10 Exercise Problem McGee Computing Service is considering an average-risk project that will cost $92,000 at time zero and is expected to generate annual after-tax cash inflow in the amount of $19,000 for the next 12 years. The firm has 300,000 shares of common stock outstanding at a price of $40 a share, 10,000 shares of preferred stock outstanding at a price of $80 a share, and 2,000 bonds outstanding at a price of 77.40 percent of par. The company's 9% preferred stock has a par value of S100 each. Its currently outstanding bonds have a face value of S 1,000, carry an annual coupon rate of g%, and wil mature in. 1O years. MeGee's most recently paid dividends on its common stock are $4 a share and the expected growth in dividends and instead will rely on retaining carnings for common equity financing. The company's applicable tax rate is 25% (Assume yearly coupon payments on the bonds. Answer the following questions is 6% per year indefinitely. It has no intention to issue additional common equity What is McGee's pre-tax cost of debt? 1. 2. What is McGee's cost of preferred stock? 3. What is McGee's cost of common stock? 4 What are McGiee's capital structure weights of debt, preferred stock, and common stock? 5. What is McGee's WACC? What action should McGee take based on the WACC derived above? 6. 7. If McGee issues additional commmon equity, it would incur a 10% notation cost, what would be the cost of its new common stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts