Question: I need the right answer in clear hand writing An investor owns a property that he bought a while back. HOLD 262 IF SOLD TODAY,

I need the right answer in clear hand writing

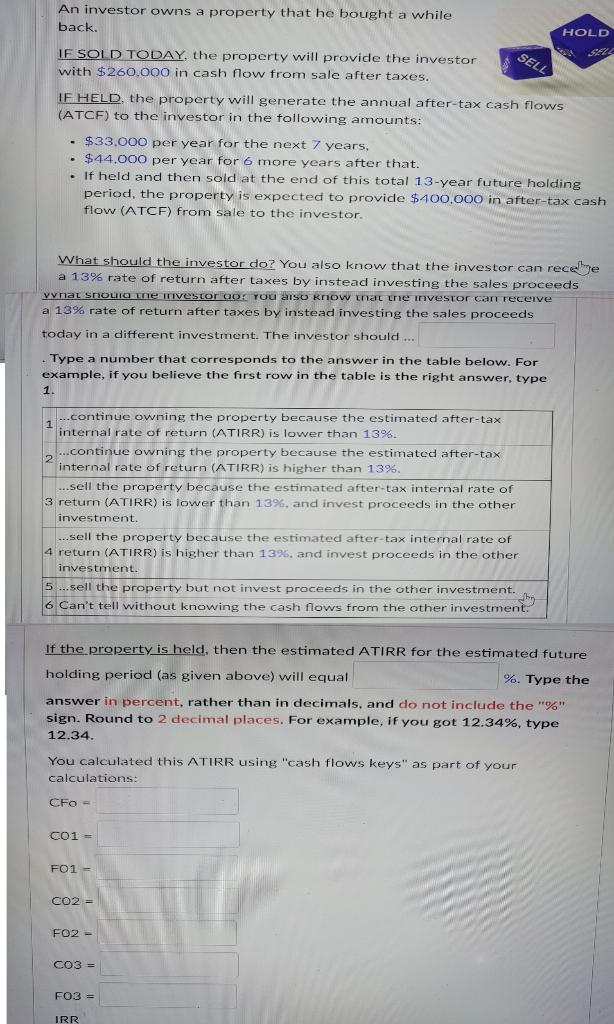

An investor owns a property that he bought a while back. HOLD 262 IF SOLD TODAY, the property will provide the investor with $260,000 in cash flow from sale after taxes. SELL IF HELD, the property will generate the annual after-tax cash flows (ATCF) to the investor in the following amounts: $33.000 per year for the next 7 years, $44.000 per year for 6 more years after that. If held and then sold at the end of this total 13-year future holding period, the property is expected to provide $400,000 in after-tax cash flow (ATCF) from sale to the investor. What should the investor do? You also know that the investor can recebe a 13% rate of return after taxes by instead investing the sales proceeds vvnat snoua me mivestor or you also know that the investor can receive a 13% rate of return after taxes by instead investing the sales proceeds today in a different investment. The investor should ... Type a number that corresponds to the answer in the table below. For example, if you believe the first row in the table is the right answer, type 1. ...continue owning the property because the estimated after-tax internal rate of return (ATIRR) is lower than 13%. ...continue owning the property because the estimated after-tax internal rate of return (ATIRR) is higher than 13%. ...sell the property because the estimated after-tax internal rate of 3 return (ATIRR) is lower than 13%, and invest proceeds in the other investment ...sell the property because the estimated after-tax internal rate of 4 return (ATIRR) is higher than 13%, and invest proceeds in the other investment. 5. ...sell the property but not invest proceeds in the other investment. 6 Can't tell without knowing the cash flows from the other investment If the property is held, then the estimated ATIRR for the estimated future holding period (as given above) will equal %. Type the answer in percent, rather than in decimals, and do not include the "%" sign. Round to 2 decimal places. For example, if you got 12.34%, type 12.34. You calculated this ATIRR using "cash flows keys" as part of your calculations: CFO - C01 = F01 - CO2 = FO2- CO3 = FO3 = IRR An investor owns a property that he bought a while back. HOLD 262 IF SOLD TODAY, the property will provide the investor with $260,000 in cash flow from sale after taxes. SELL IF HELD, the property will generate the annual after-tax cash flows (ATCF) to the investor in the following amounts: $33.000 per year for the next 7 years, $44.000 per year for 6 more years after that. If held and then sold at the end of this total 13-year future holding period, the property is expected to provide $400,000 in after-tax cash flow (ATCF) from sale to the investor. What should the investor do? You also know that the investor can recebe a 13% rate of return after taxes by instead investing the sales proceeds vvnat snoua me mivestor or you also know that the investor can receive a 13% rate of return after taxes by instead investing the sales proceeds today in a different investment. The investor should ... Type a number that corresponds to the answer in the table below. For example, if you believe the first row in the table is the right answer, type 1. ...continue owning the property because the estimated after-tax internal rate of return (ATIRR) is lower than 13%. ...continue owning the property because the estimated after-tax internal rate of return (ATIRR) is higher than 13%. ...sell the property because the estimated after-tax internal rate of 3 return (ATIRR) is lower than 13%, and invest proceeds in the other investment ...sell the property because the estimated after-tax internal rate of 4 return (ATIRR) is higher than 13%, and invest proceeds in the other investment. 5. ...sell the property but not invest proceeds in the other investment. 6 Can't tell without knowing the cash flows from the other investment If the property is held, then the estimated ATIRR for the estimated future holding period (as given above) will equal %. Type the answer in percent, rather than in decimals, and do not include the "%" sign. Round to 2 decimal places. For example, if you got 12.34%, type 12.34. You calculated this ATIRR using "cash flows keys" as part of your calculations: CFO - C01 = F01 - CO2 = FO2- CO3 = FO3 = IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts