Question: I need the right answer in clear hand writing Find the missing cash flows in the following accrual loan problem! Orlando Investments is buying an

I need the right answer in clear hand writing

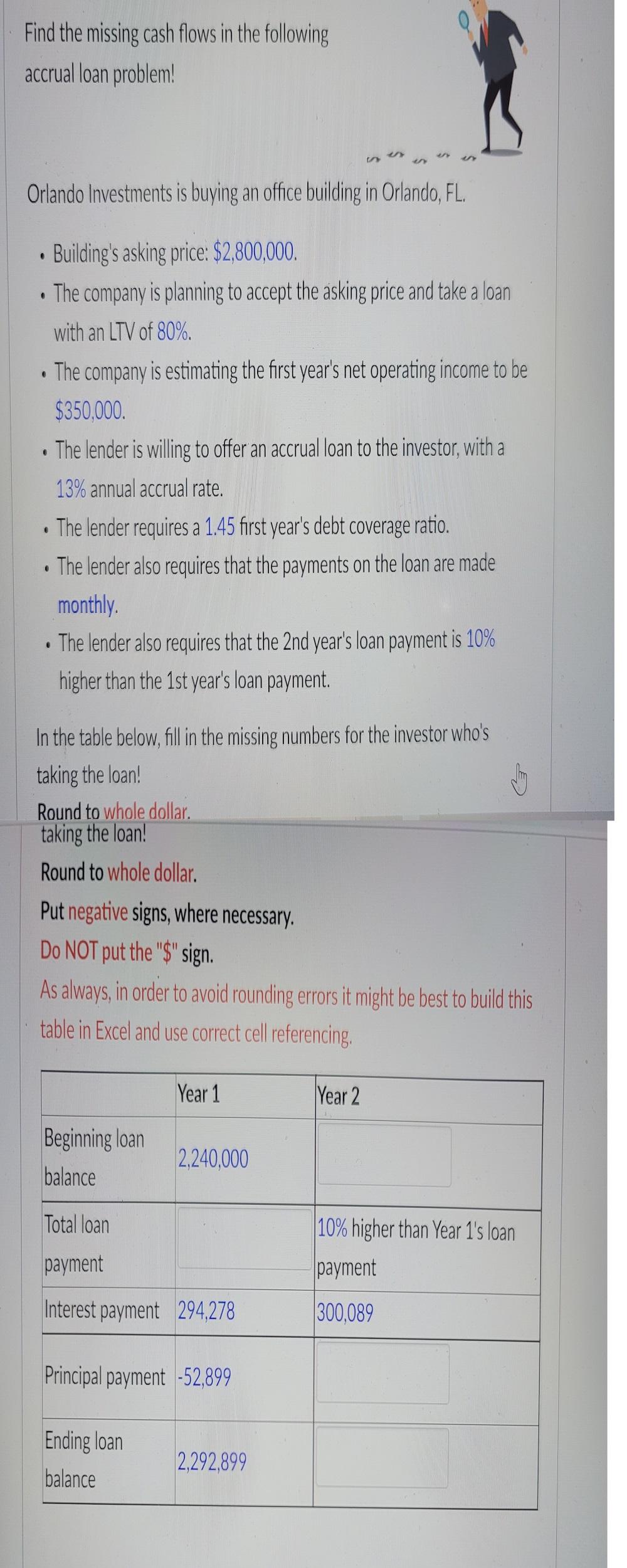

Find the missing cash flows in the following accrual loan problem! Orlando Investments is buying an office building in Orlando, FL. . Building's asking price: $2,800,000. The company is planning to accept the asking price and take a loan with an LTV of 80%. The company is estimating the first year's net operating income to be $350.000 The lender is willing to offer an accrual loan to the investor, with a 13% annual accrual rate. The lender requires a 1.45 first year's debt coverage ratio. The lender also requires that the payments on the loan are made monthly. The lender also requires that the 2nd year's loan payment is 10% higher than the 1st year's loan payment. In the table below, fill in the missing numbers for the investor who's taking the loan! Round to whole dollar. taking the loan! Round to whole dollar. Put negative signs, where necessary. Do NOT put the "$" sign. As always, in order to avoid rounding errors it might be best to build this table in Excel and use correct cell referencing. Year 1 Year 2 Beginning loan balance 2.240.000 Total loan 10% higher than Year 1's loan payment payment Interest payment 294,278 300.089 Principal payment -52,899 Ending loan balance 2,292,899 Find the missing cash flows in the following accrual loan problem! Orlando Investments is buying an office building in Orlando, FL. . Building's asking price: $2,800,000. The company is planning to accept the asking price and take a loan with an LTV of 80%. The company is estimating the first year's net operating income to be $350.000 The lender is willing to offer an accrual loan to the investor, with a 13% annual accrual rate. The lender requires a 1.45 first year's debt coverage ratio. The lender also requires that the payments on the loan are made monthly. The lender also requires that the 2nd year's loan payment is 10% higher than the 1st year's loan payment. In the table below, fill in the missing numbers for the investor who's taking the loan! Round to whole dollar. taking the loan! Round to whole dollar. Put negative signs, where necessary. Do NOT put the "$" sign. As always, in order to avoid rounding errors it might be best to build this table in Excel and use correct cell referencing. Year 1 Year 2 Beginning loan balance 2.240.000 Total loan 10% higher than Year 1's loan payment payment Interest payment 294,278 300.089 Principal payment -52,899 Ending loan balance 2,292,899

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts