Question: I need the right answer please I have keep sending this question for 3rd time please guys I need the right answer Q24 Newt is

I need the right answer please I have keep sending this question for 3rd time please guys I need the right answer

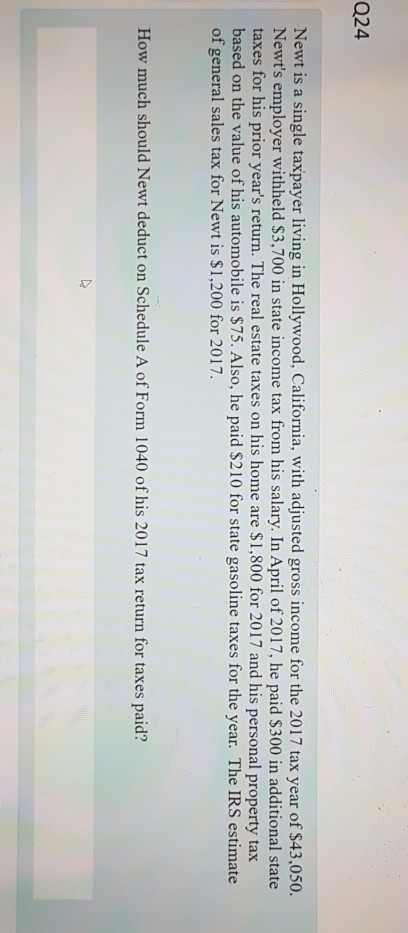

Q24 Newt is a single taxpayer living in Hollywood, California, with adjusted gross income for the 2017 tax year of $43,050. Newt's employer withheld $3,700 in state income tax from his salary. In April of 2017, he paid $300 in additional state taxes for his prior year's return. The real estate taxes on his home are $1,800 for 2017 and his personal property tax based on the value of his automobile is $75. Also, he paid $210 for state gasoline taxes for the year. The IRS estimate of general sales tax for Newt is $1,200 for 2017. How much should Newt deduct on Schedule A of Form 1040 of his 2017 tax return for taxes paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts