Question: I need the solution and the answer of this question. I am in a hurry, so quick response will be appreciated. Thank you! Domestic. Corp,

I need the solution and the answer of this question. I am in a hurry, so quick response will be appreciated. Thank you!

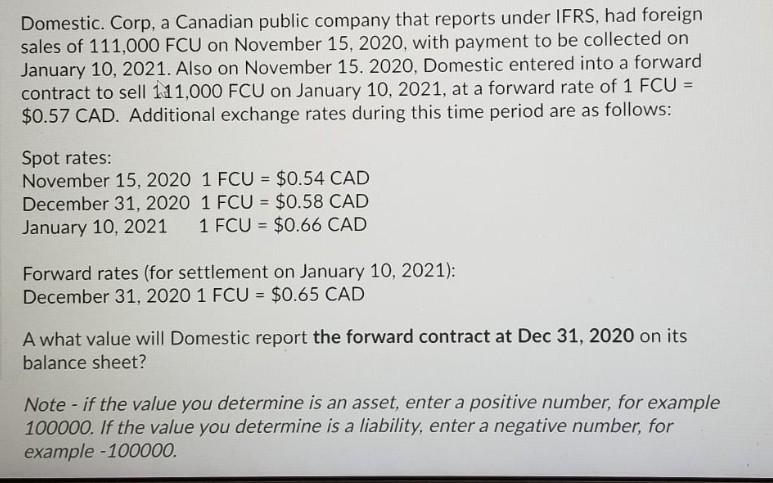

Domestic. Corp, a Canadian public company that reports under IFRS, had foreign sales of 111,000 FCU on November 15, 2020, with payment to be collected on January 10, 2021. Also on November 15. 2020, Domestic entered into a forward contract to sell 111,000 FCU on January 10, 2021, at a forward rate of 1 FCU = $0.57 CAD. Additional exchange rates during this time period are as follows: Spot rates: November 15, 2020 1 FCU = $0.54 CAD December 31, 2020 1 FCU = $0.58 CAD January 10, 2021 1 FCU = $0.66 CAD Forward rates (for settlement on January 10, 2021): December 31, 2020 1 FCU = $0.65 CAD A what value will Domestic report the forward contract at Dec 31, 2020 on its balance sheet? Note - if the value you determine is an asset, enter a positive number, for example 100000. If the value you determine is a liability, enter a negative number, for example - 100000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts